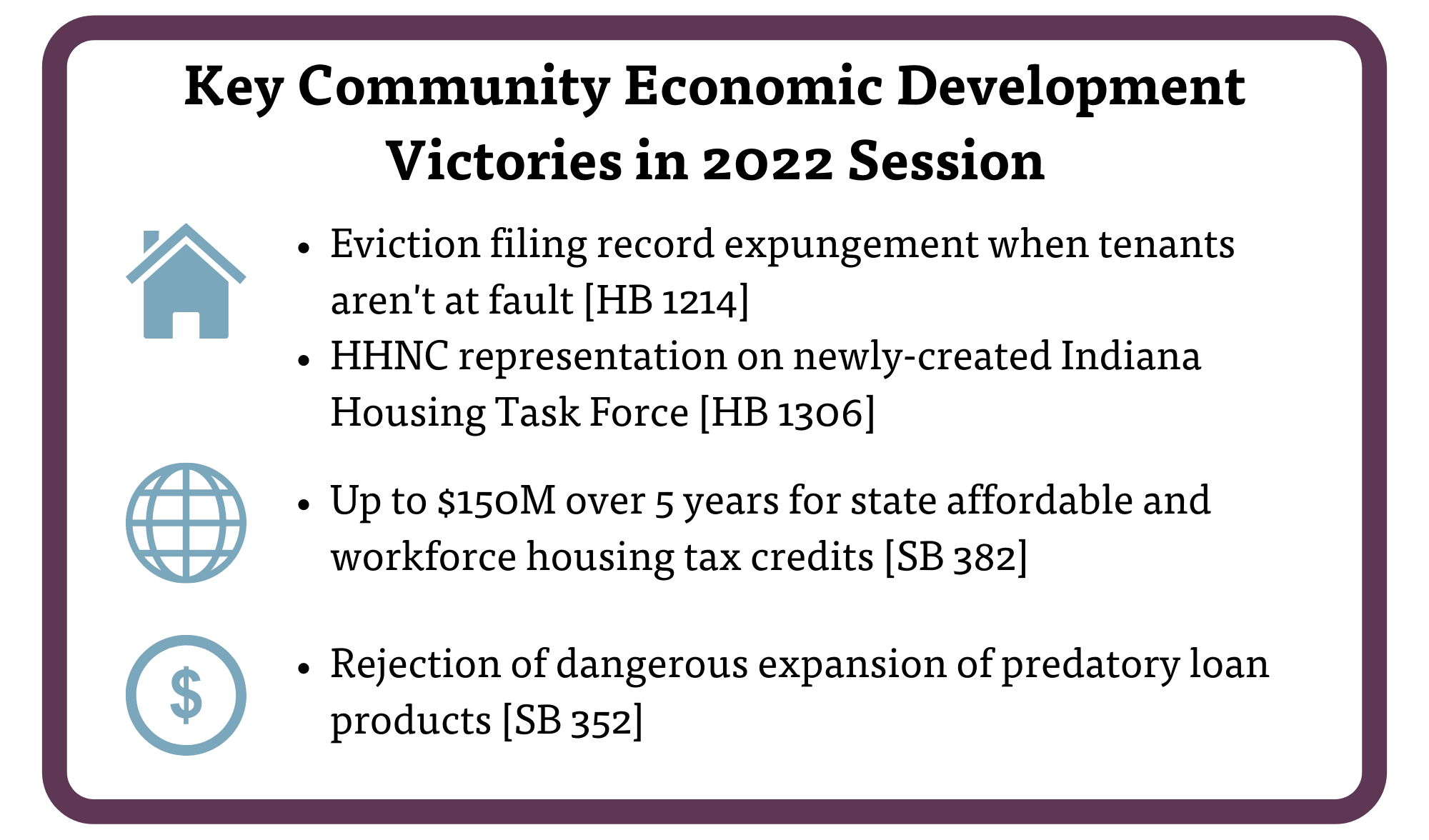

Although the 2022 session of the Indiana General Assembly was a ‘short session’ in a non-budget year lasting only nine weeks, legislation that passed (and failed) has the potential for long-lasting impact for Prosperity Indiana members and the state’s community economic development sector. PI member involvement this session helped pass legislation that will seal eviction filing records, secure $150 million in affordable housing state tax credits, and prevent the expansion of predatory small loans statewide.

Following the feedback of members who told us that the pandemic continues to disproportionately affect vulnerable Hoosiers in their communities and strain their capacity to serve them, PI sought to respond to these short-term critical needs while building resources and policy structures to strengthen Indiana’s communities in the long term. Our 2022 Policy Agenda: Rebuilding Stronger, More Equitable Indiana Communities focused on opportunities to rebuild communities through recovery efforts for the hardest-hit Hoosiers; strengthening the infrastructure of resources for the state’s community economic development sector; and permanently improving the lives of Hoosiers long neglected by public policies.

Throughout the session, Prosperity Indiana members stepped up to act on these priorities. Members took center stage when we unveiled our agenda in a live event with legislators before the session, drove hundreds of miles to participate in PI’s Statehouse Day in January and testify before committees, and made countless calls and emails to legislators over the short session to explain how PI’s priority legislation would help them serve Indiana’s communities. Here are the results of those efforts and the outcomes of the legislation most directly tied to PI’s agenda:

AFFORDABLE HOUSING

HB 1214: Residential eviction actions (Rep. Ethan Manning) included a provision that will seal eviction filing records when the case doesn’t go to court or is found in the tenant’s favor. This provision has been a top PI agenda item and a priority of the PI-convened Hoosier Housing Needs Coalition (HHNC) for the past two sessions. The bill also requires courts to track and compile this data and that all emergency rental assistance programs create a designated landlord application process. PI remains concerned with provisions that require all court-based eviction diversion programs to be voluntary and encourages the legislature to revisit this provision if it does not increase the uptake in such programs. The bill passed with 49-0 votes in the Senate and 91-0 in the House.

HB 1306: Housing task force (Rep. Doug Miller) named the PI-convened Hoosier Housing Needs Coalition to the newly-created Indiana Housing Task Force, which will be charged with reviewing issues related to housing and housing shortages in Indiana and issuing a report to the General Assembly and the Governor by November 1, 2022. The bill passed with 48-0 votes in the Senate and 88-2 in the House.

While SB 230: Enforcement of habitability standards (Sen. Fady Qaddoura) was not granted a hearing in the House after passing the Senate 47-1, the broad bipartisan support provides momentum for interim study of the habitability standards for residential rental units, including the issue of jurisdictional questions. Also regarding habitability enforcement, HB 1048: Sheriff's sale in mortgage foreclosure action (Rep. Sean Eberhart) passed and prevents predatory and negligent landlords, including those from out of state and out of country, from buying foreclosed property in online sheriffs’ sales. The final votes on HB 1048 were 50-0 in the Senate and 87-3 in the House.

COMMUNITY DEVELOPMENT RESOURCES

SB 382: Various tax matters (Sen. Travis Holdman) included provisions originally in SB 262 (Sen. Travis Holdman) providing up to $30 million annually over five years in affordable and workforce housing state tax credits, for a total of up to $150 million. PI testified in favor of this provision in committee and supported the bill that has been considered in various versions since first introduced five years ago. SB 382 passed with 38-12 votes in the Senate and 66-32 in the House.

The provisions of SB 292: Land banks (Sen. Tim Lanane) that would have required counties to provide a list of eligible properties to land banks, as well as an optional transfer of those properties, were added to SB 62: Sale of tax sale properties to nonprofits (Sen. Michael Young) during conference committee in the last week of session. However, due to disagreements in caucus that were not made public, SB 292 language was stripped out of the conference committee report, and SB 62 passed without them. The final votes on SB 62 were 50-0 in the Senate and 91-2 in the House. Despite this setback, look for broader recommendations from PI’s Land Bank Incubator Scholarship team to be introduced next session.

CONSUMER PROTECTION/ASSET DEVELOPMENT

Despite broad bipartisan support, committees did not hear HB 1159 (Rep. Carey Hamilton) or SB 253 (Sen. Ron Alting) ‘Small loan finance charges’ that would have capped payday APRs at 36%. However, Hoosier consumers were protected from an expansion of predatory lending when the House refused to hear SB 352: Supervised consumer loans after it passed the Senate by a narrow margin. As the PI co-convened Hoosiers for Responsible Lending (HRL) stated, SB 352 would have “drastically change[d] subprime, high-cost installment lending across Indiana by increasing the finance charges and fees, compared to current law, [allowing] lenders to aggressively push borrowers to refinance these installment loans as often as possible.” Prosperity Indiana and HRL are committed to working with legislators before next session on solutions and alternatives that provide equitable and responsible access to credit.

Beyond these agenda priority bills, Prosperity Indiana tracks a wide array of legislation impacting the community economic development sector. See the final outcomes for all of the bills we tracked during the 2022 session:

Thanks again to all Prosperity Indiana members and coalition partners who advocated for our priorities this session and helped secure several key victories that will have a positive impact for Indiana’s communities over the long term. If you are new to PI, please sign up for email and action alerts to keep up to date with policy and advocacy efforts throughout the year.