FOR IMMEDIATE RELEASE

July 28, 2022

Contact: Andrew Bradley | (317) 222-1221 x403 | abradley@prosperityindiana.org

Affordable Housing is Out of Reach and Getting More Expensive for Low-Wage Hoosiers

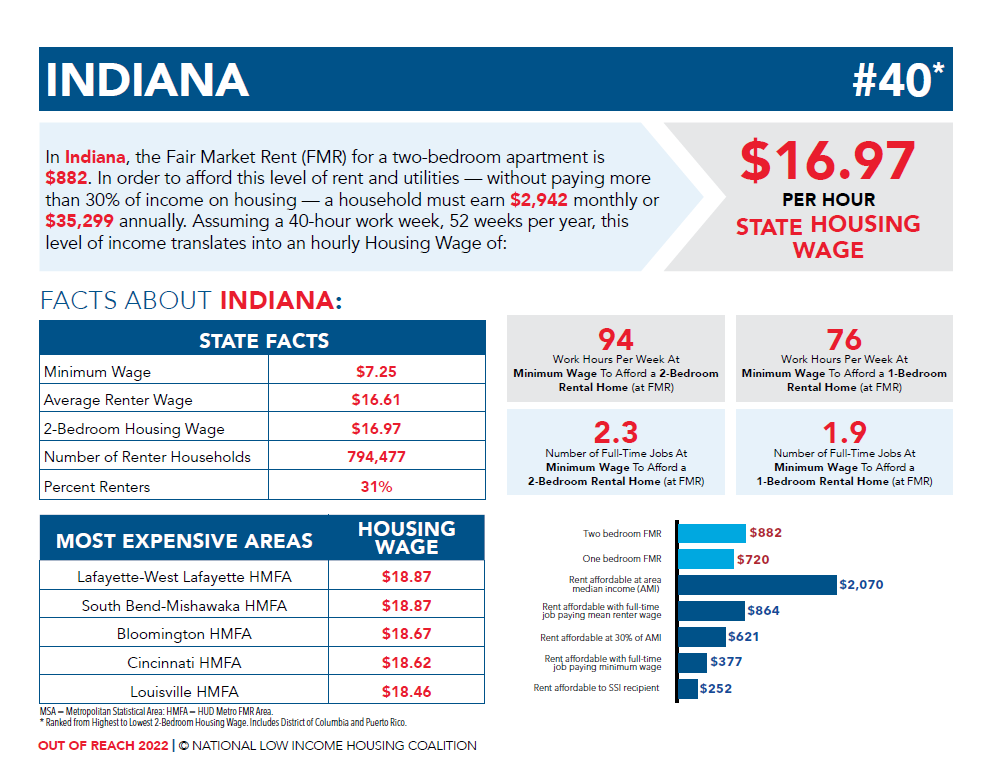

INDIANAPOLIS, IN - In order to afford a modest, two-bedroom apartment at fair market rent in Indiana in 2022, full-time workers need to earn $16.97 per hour, up from $16.57 a year ago. This is Indiana’s 2022 Housing Wage, revealed in a national report published today. The report, Out of Reach, is jointly released by the National Low Income Housing Coalition (NLIHC), a research and advocacy organization dedicated to achieving affordable and decent homes for people with the lowest incomes, and Prosperity Indiana, the statewide association for community economic development.

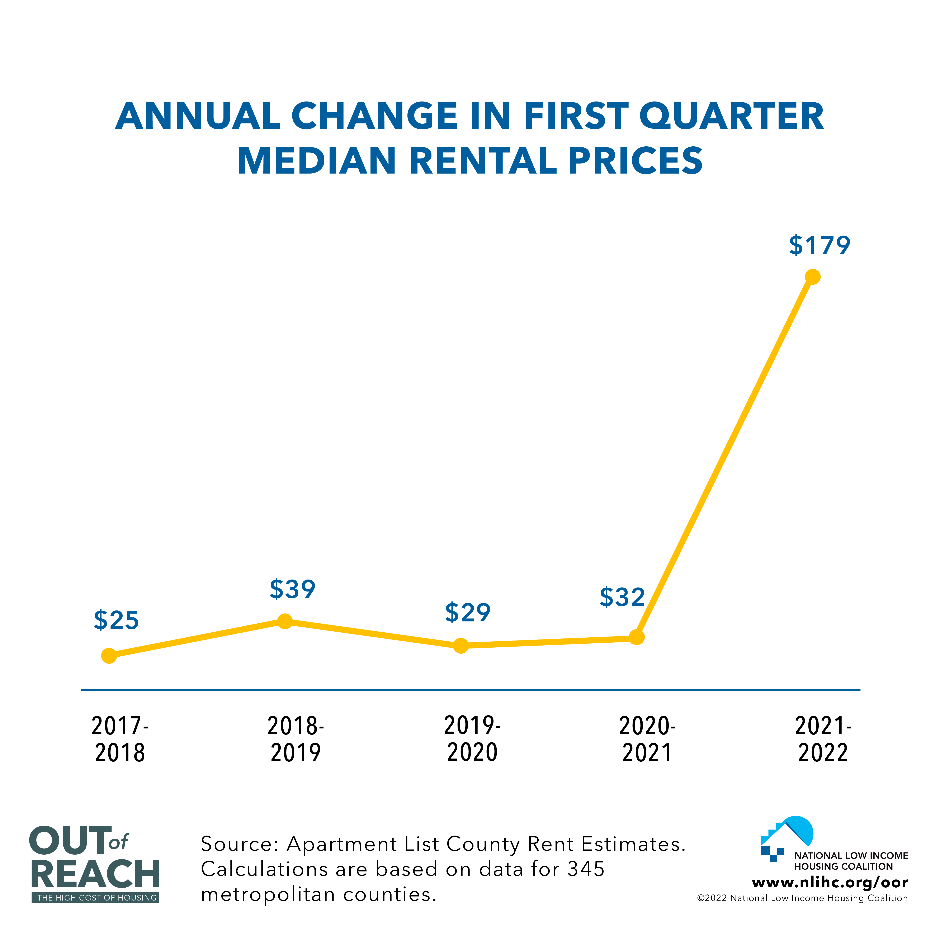

This year, the Out of Reach report is being released amid record-high inflation and rising rental costs. These rent increases are affecting tenants nationwide, with median rents for two-bedroom apartments increasing nearly 18% between the first quarter of 2021 and the first quarter of 2022. At the same time, costs for necessities like food and transportation have also skyrocketed, leaving low-income renters with increasingly tighter budgets. With inflation breaking a 40-year record in 2022, many renters have had to make difficult decisions about their budget, sacrificing childcare, medical care, and food to maintain housing.

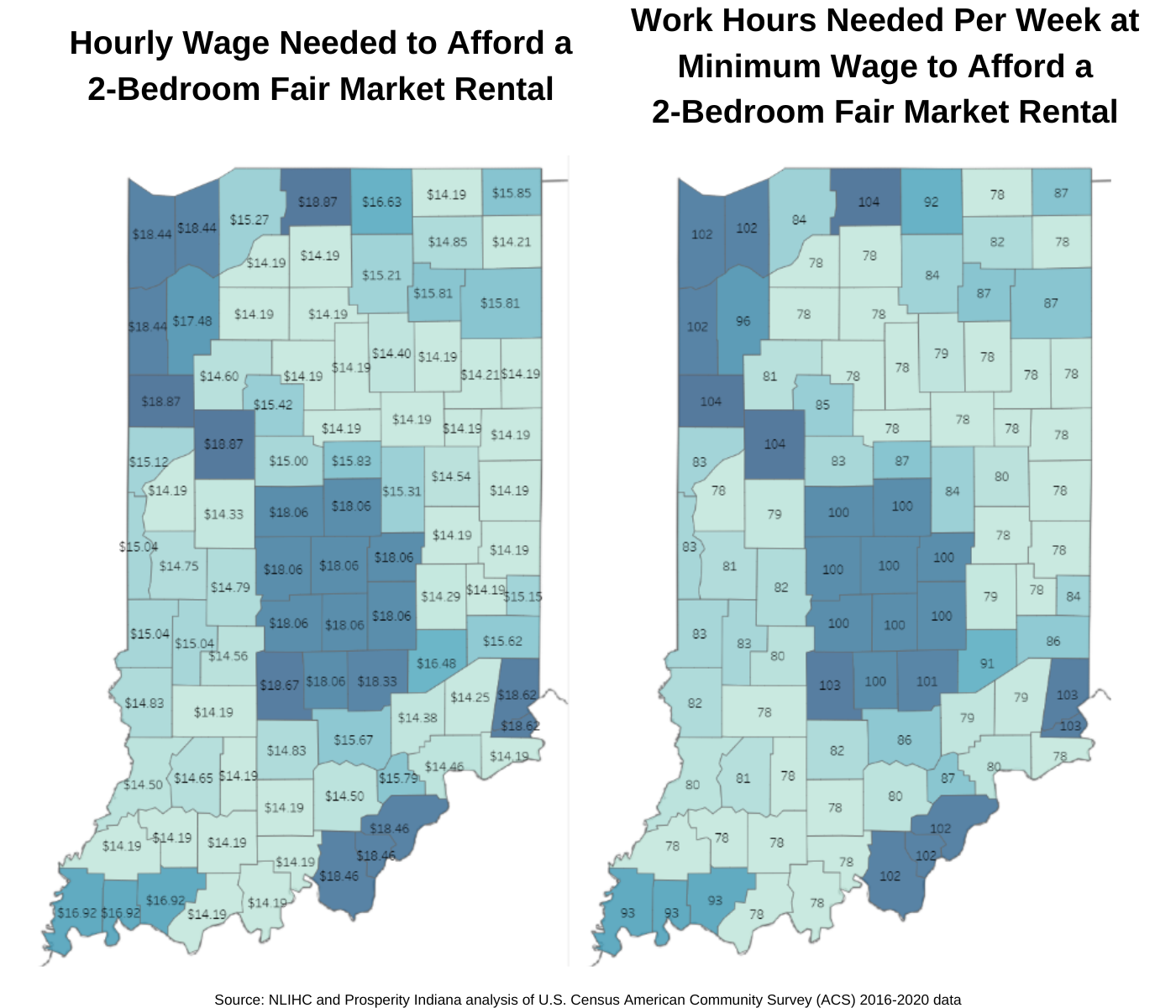

In Indiana, a renter needs to earn on average $14.19 to $18.87 per hour, depending on location, to afford a modest two-bedroom rental home without spending more than 30% of their income on housing costs. For Hoosiers, the Housing Wage is above the statewide median in 23 counties covering rural, suburban, and urban parts of the state.

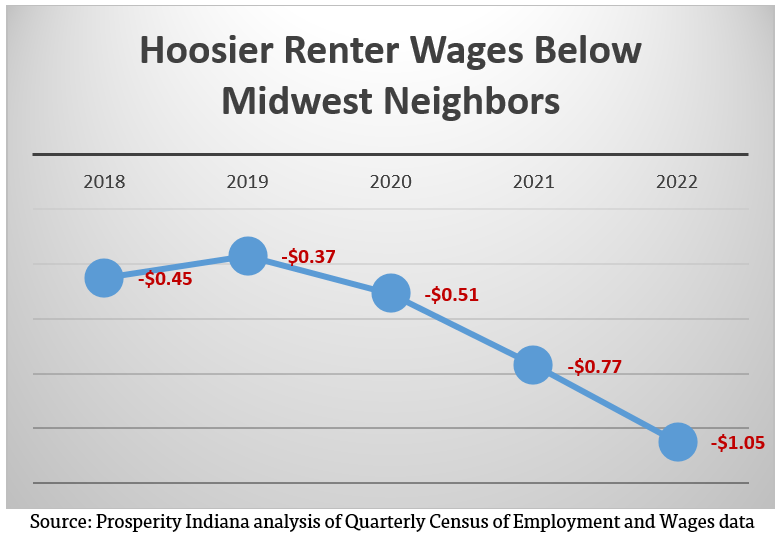

The new report finds that the combination of inflated costs and wages increasingly out of step with neighboring states means that housing is getting further out of reach for Hoosier renters. Despite a reputation of being a low-cost state, the housing wage in Indiana has worsened from 43rd-least affordable in the nation in 2021 to 40th in just one year. Among Midwest states, Hoosier renter wages remain consistently and increasingly behind those in the region. In 2022, the mean renter wage of $16.61 is now $1.05 an hour lower than the $17.66 mean renter wage across all Midwest states. This means Hoosier renters working full time make $2,184 less each year than the typical Midwest renter. Filling that wage gap would pay for nearly 2.5 months of the state’s fair-market rent for a two-bedroom unit at $882/month.

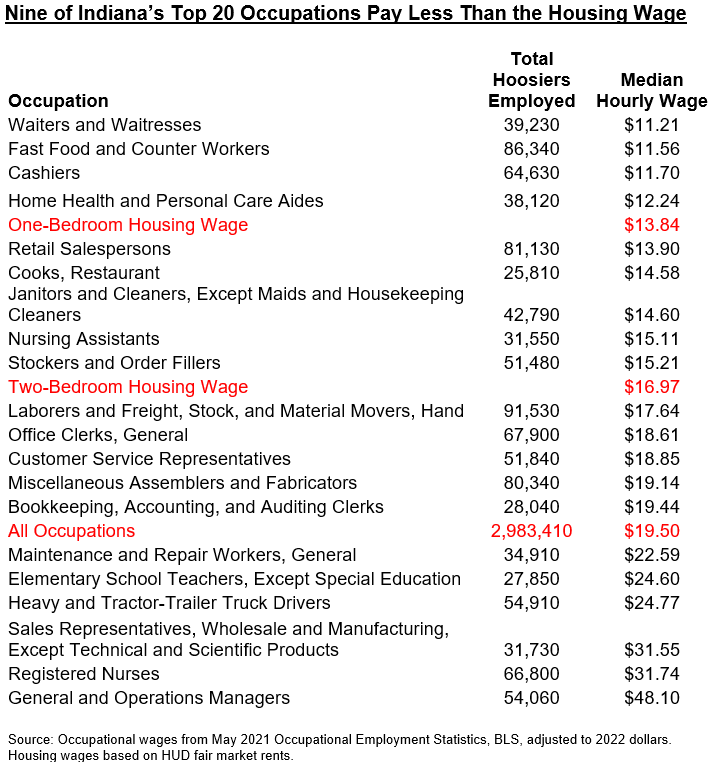

The report also finds that nine of Indiana’s top 20 largest occupations pay a lower median wage than a full-time Hoosier worker needs for the state’s housing wage for a modest two-bedroom apartment at the state’s fair market rent. Among the state’s top 20 largest occupations, 228,320 Hoosiers work as waiters and waitresses, fast food and counter workers, cashiers, and home health and personal care aides where the median wage is insufficient even for a one-bedroom unit. These are some of the same occupations that employers report having the hardest time keeping positions filled.

“To lighten the burden of increased housing costs, Indiana’s policymakers should support efforts to increase the supply of new housing at attainable prices for renters,” said Jessica Love, executive director for Prosperity Indiana.

“Preserving and rehabilitating aging units and enforcing habitability standards are both critical components in ensuring all Hoosiers have a decent and affordable place to live.”

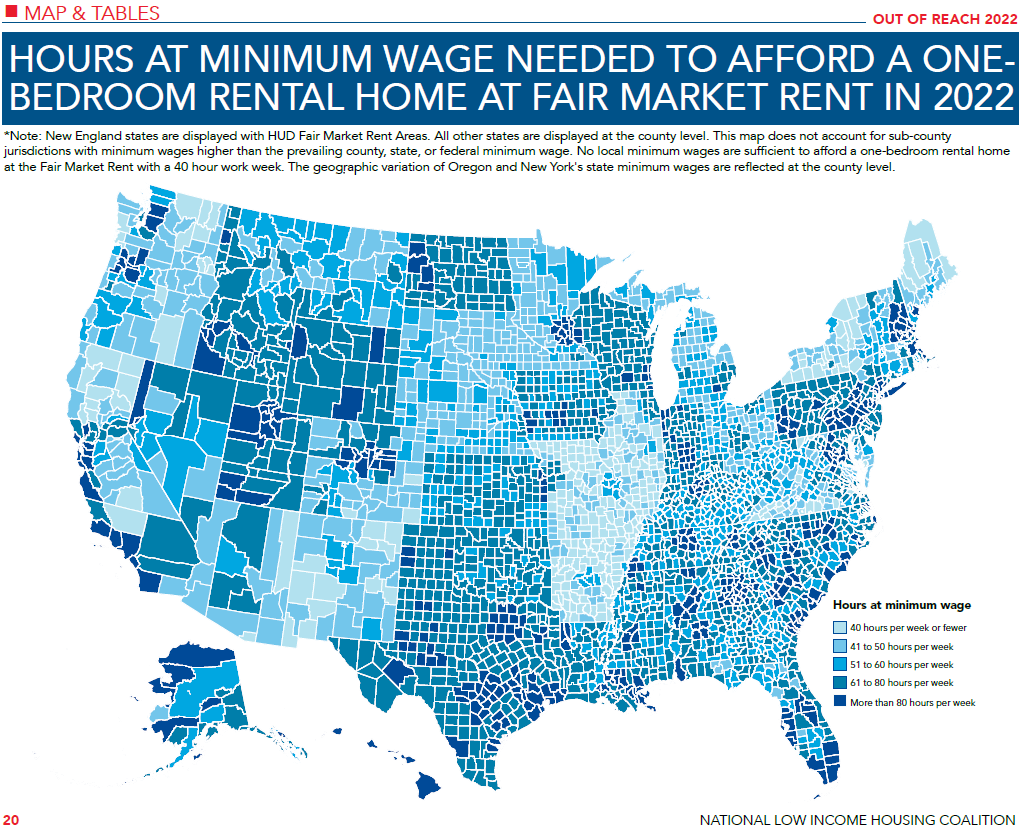

The increased cost of housing is also causing inflation in the number of hours Hoosiers working minimum wage must work to afford rent. The federal minimum wage has remained at $7.25 an hour without an increase since 2009, and Indiana has remained tied to that national wage floor. In no Indiana county or metro area can a minimum-wage renter working a 40-hour workweek afford even a modest studio rental unit at the average fair market rent. Working at the minimum wage of $7.25 in Indiana, a Hoosier wage earner must have 1.9 full-time jobs or work 76 hours per week to afford a modest one-bedroom apartment; or earn 2.3 full-time jobs or work 94 hours per week to afford a two-bedroom apartment. To afford a two-bedroom apartment at minimum wage across all 92 Indiana counties, the estimated hours needed range from 78 to 104 hours worked per week. This means that minimum-wage Hoosier workers in Benton, St. Joseph, and Tippecanoe Counties must work longer per week (104 hours) to afford a two-bedroom unit than workers in Washington, DC (85 hours), Portland, OR (99 hours), or Los Angeles County, CA (99 hours).

“Decades of chronic underfunding for housing assistance have resulted in a housing-lottery system, where only 25 percent of eligible households receive the housing assistance they need,” said NLIHC President and CEO Diane Yentel. “With rents rising rapidly, homelessness worsening, and millions of families struggling to stay housed, federal investments in expanding proven solutions – like Housing Choice Vouchers, the national Housing Trust Fund, and public housing – are badly needed and long overdue. As a country, we have the data, partnerships, expertise, solutions, and means to end homelessness and housing poverty – we lack only the political will to fund solutions at the scale necessary.”

For additional information, visit: http://www.nlihc.org/oor

###

About Prosperity Indiana

The Indiana Association for Community Economic Development d/b/a Prosperity Indiana builds a better future for our communities by providing advocacy, leveraging resources, and engaging an empowered network of members to create inclusive opportunities that build assets and improve lives. Since its founding in 1986, Prosperity Indiana’s network has grown to nearly 200 organizations, representing thousands of practitioners statewide from the public, private, and nonprofit sectors.

About the National Low Income Housing Coalition

The National Low Income Housing Coalition is dedicated to achieving racially and socially equitable public policy that ensures people with the lowest incomes have quality homes that are accessible and affordable in the communities of their choice. NLIHC educates, organizes, and advocates to ensure decent, affordable housing for everyone. For more information about NLIHC, please visit www.nlihc.org.