FOR IMMEDIATE RELEASE

March 16, 2023

Contact: Andrew Bradley | (317) 222-1221 x403| abradley@prosperityindiana.org

The Shortage of Affordable Housing is Worst for Hoosier Renters with Extremely Low Incomes in all 92 Counties; Indiana's Supply and Cost Burden Remains Behind Midwest Average

By Andrew Bradley, Erica Boswell, Hale Crumley, and Maya Painter

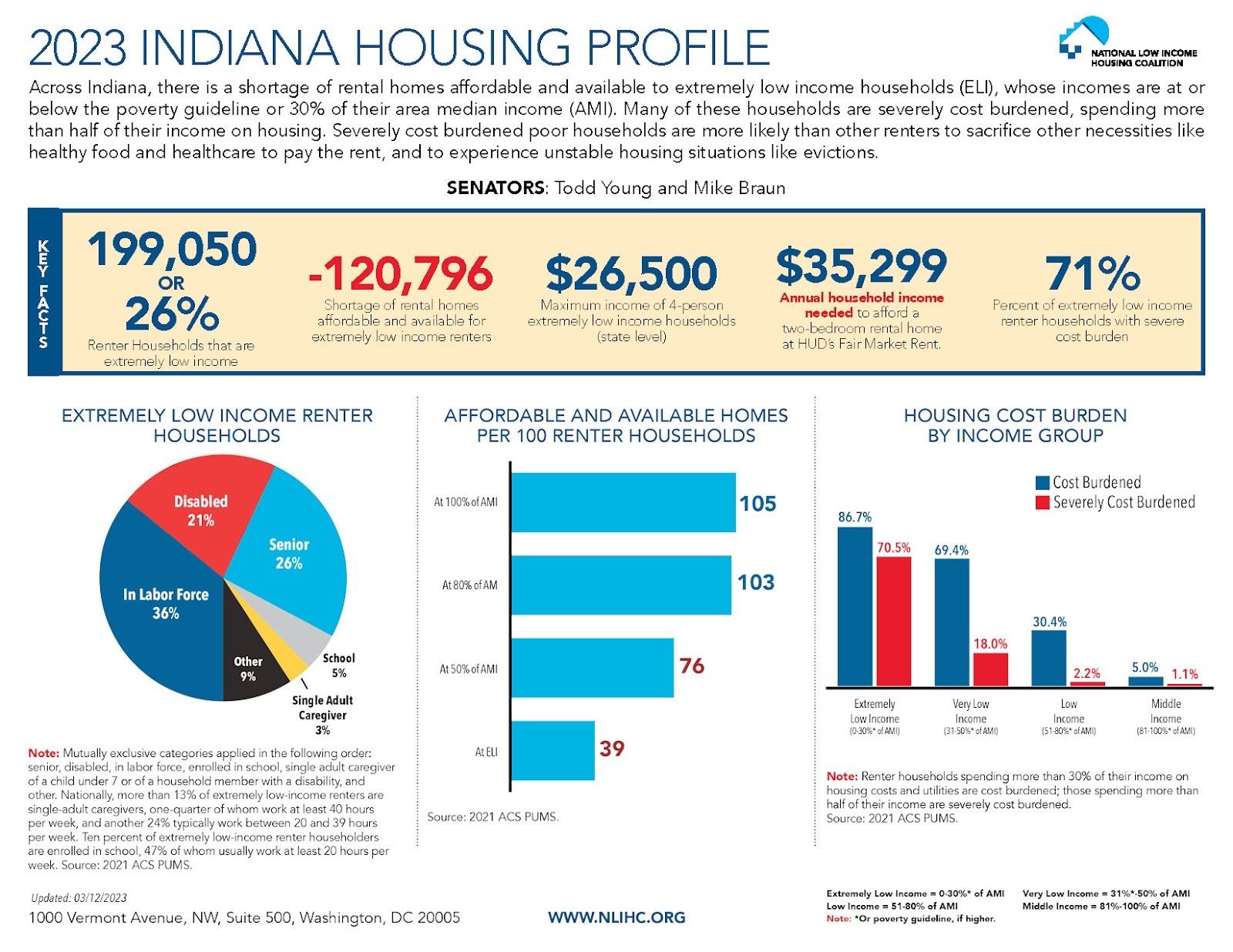

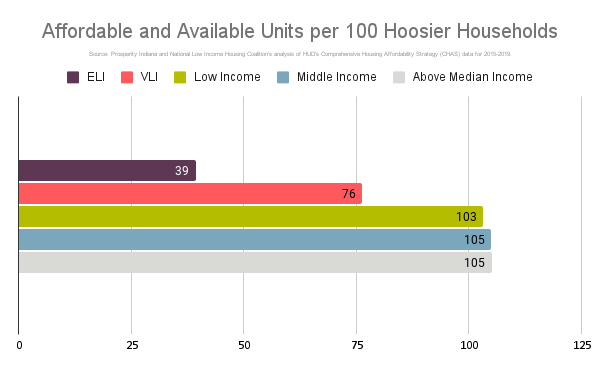

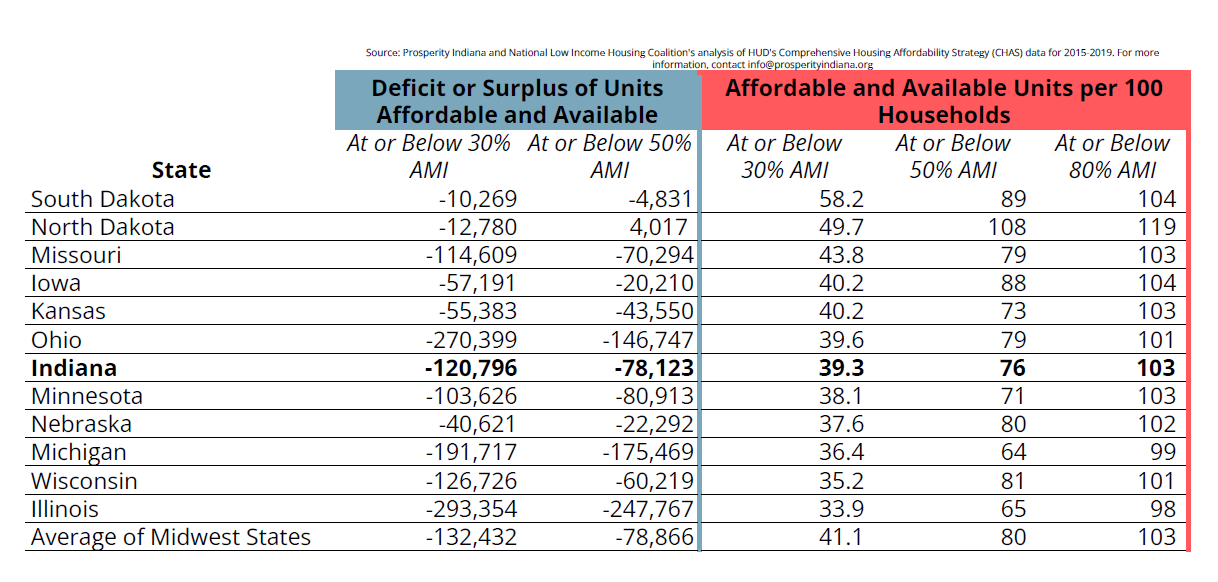

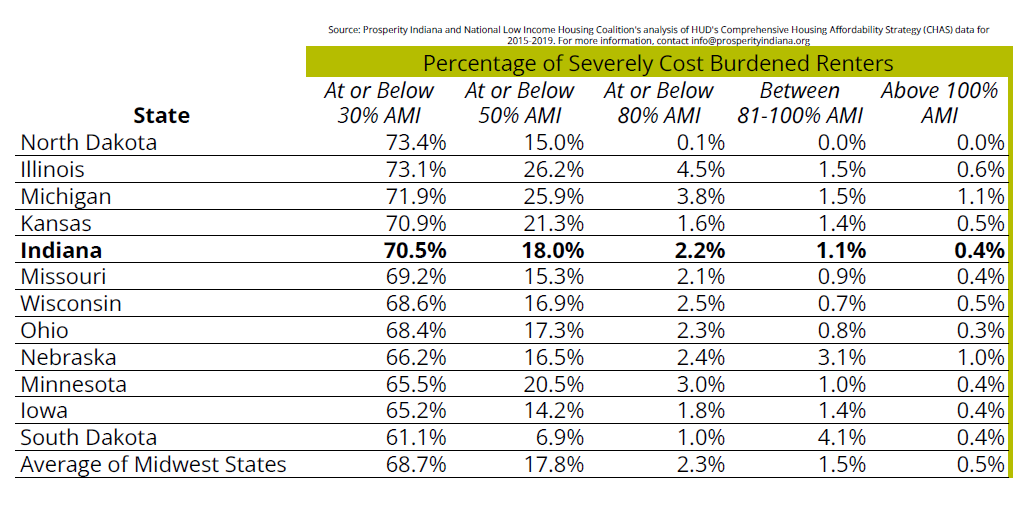

INDIANAPOLIS, IN- The Gap: A Shortage of Affordable Homes, a new report released today by the National Low Income Housing Coalition (NLIHC) and Prosperity Indiana, finds that Indiana’s shortage of affordable housing and severe housing cost burden is statewide and is concentrated in extremely low-income renter households in all 92 counties. The new report finds a statewide shortage of 120,796 affordable and available rental homes for extremely low-income renter households, defined as those with incomes at or below the poverty level or 30% of their area median income, whichever is greater. This means there are just 39 affordable and available rental homes for every 100 extremely low income Hoosier renter households. As a result, 70% of the most vulnerable renter households are severely housing cost-burdened, spending more than half of their incomes on housing, with little left over for basic necessities. Both measures underperform the regional average for Midwest states, continuing a years’-long trend. In addition, the report finds that Black and brown Hoosier households are twice or more as likely to be extremely-low income renters than white households, and bear a disproportionate burden of Indiana’s shortage of affordable housing.

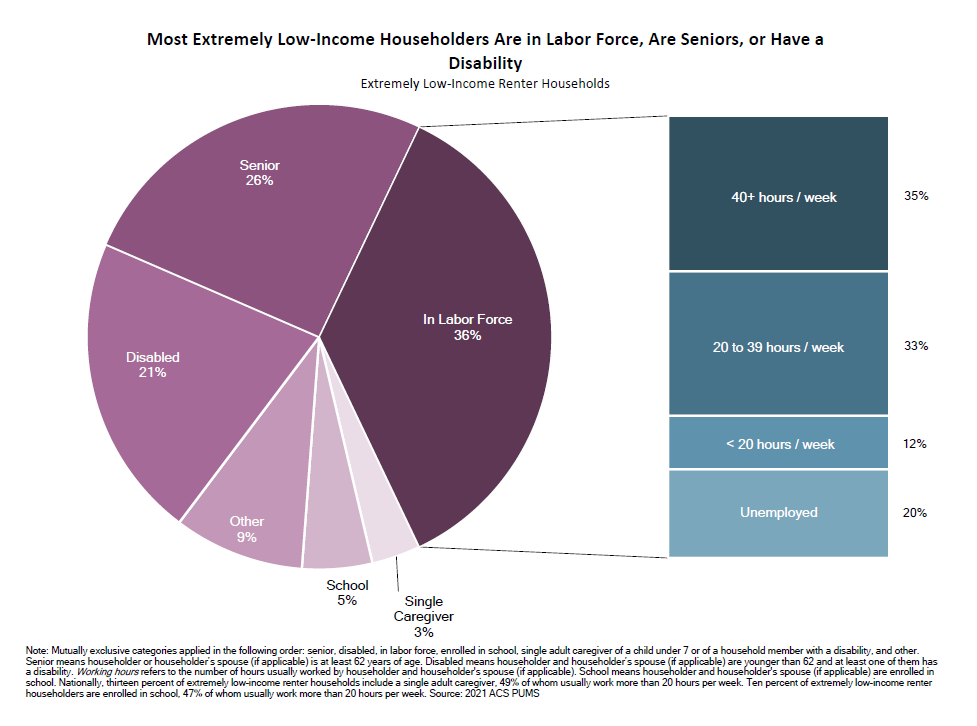

The report confirms that Indiana’s largest housing gaps and cost burdens are borne by the lowest-income Hoosier renters who comprise some of the most vulnerable populations in the state. At 36%, the greatest proportion of these extremely low-income renter households are in the workforce, along with older Hoosiers at 26% (increasing from 21% in 2022), disabled Hoosiers at 21%, students at 5%, caregivers at 3%, and other households at 9%. Of the plurality of Indiana’s extremely low-income households who are in the labor force, over two-thirds of these Hoosiers are working more than part-time hours, with the greatest proportion (35%) working 40 hours or more per week and another 33% working between 20 and 39 hours per week. Another 12% work fewer than 20 hours per week and the remaining 20% are in the labor force but are jobless, looking for a job, and available for work.

The new report finds that Indiana’s gap in affordable housing is part of a national shortage of 7.3 million affordable and available rental homes for the lowest-income households. Every year, The Gap reports on the severe shortage of affordable rental homes available to extremely low-income families and individuals. The new Gap report finds that the economic repercussions of the COVID-19 pandemic, followed by significant rent increases, drastically impacted the supply of affordable and available rental homes, nationally, in recent years. While rental inflation has cooled going into 2023, extremely low-income renters will continue to face significant barriers to finding and maintaining affordable housing, as their incomes are insufficient to cover even modest rental prices.

The Gap 2023 finds that Indiana’s largest housing deficit is by far among its lowest income households, a shortage that also makes up the largest housing gap for the Hoosiers earning below 80% of the state’s median income. When considered cumulatively along with Extremely Low Income (ELI) households, Very Low Income Hoosier households (those earning between 0-50% AMI) experience a smaller but still substantial gap of 78,123 affordable and available units. This equals a rate of 76 units for every 100 households earning below half of AMI statewide. But The Gap data finds that, at or below 80% Area Median Income, a population known as Low Income (LI), there is an absolute surplus of 16,336 affordable and available rental units in Indiana, equaling a rate of 103 units for every 100 of these LI households. And above the statewide median income, there is an absolute surplus of 39,223 affordable and available units. So while small localized gaps can and do exist, for every 100 Hoosier households making above median income there is an average of 105 affordable and available units.

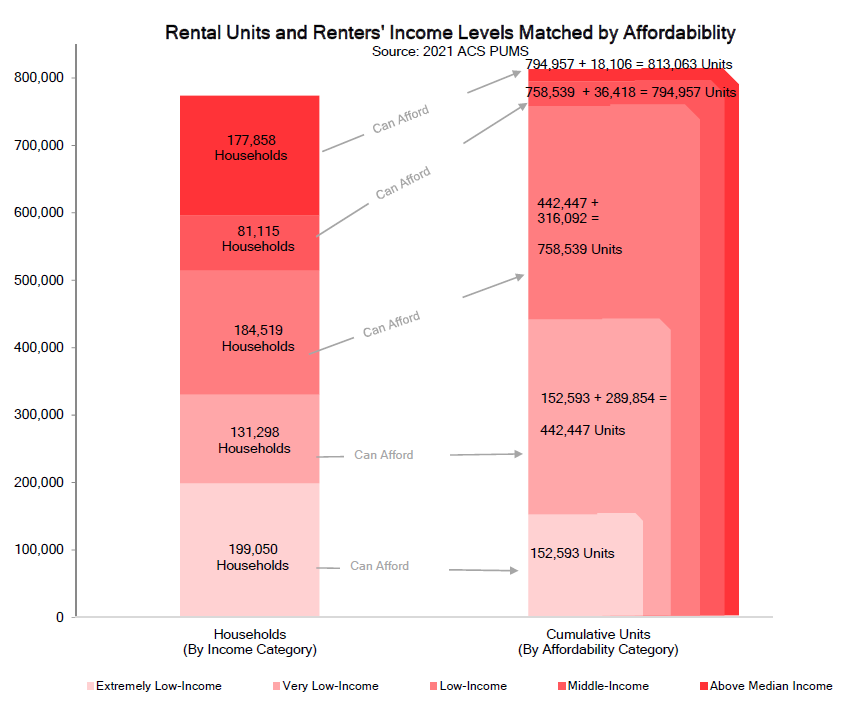

The housing gap for affordable and available housing in Indiana means that while the highest-earning households have their pick among all rental units, Hoosiers at lower income levels must compete for the remaining available housing stock that is affordable at their income level. For example, the 177,858 households earning above median income can afford any of the state’s 813,063 rental units, and the 81,115 households in the state’s middle income range can afford 794,957 of those units. But when those households choose to rent a unit that would be affordable to families making less than middle-income, that unit is no longer available on the market to lower-income households. So while there are already only 152,592 units affordable in price to Indiana’s 199,050 extremely low-income households, the ‘picking over’ effect contributes to the state’s gap of 120,796 units that are both affordable and available to this population. Also contributing to the lack of supply for ELI households is the fact that Indiana is only 1 of 6 states nationwide without habitability enforcement mechanisms, which artificially depletes the housing supply while increasing the severe housing cost burden for the most vulnerable Hoosiers.

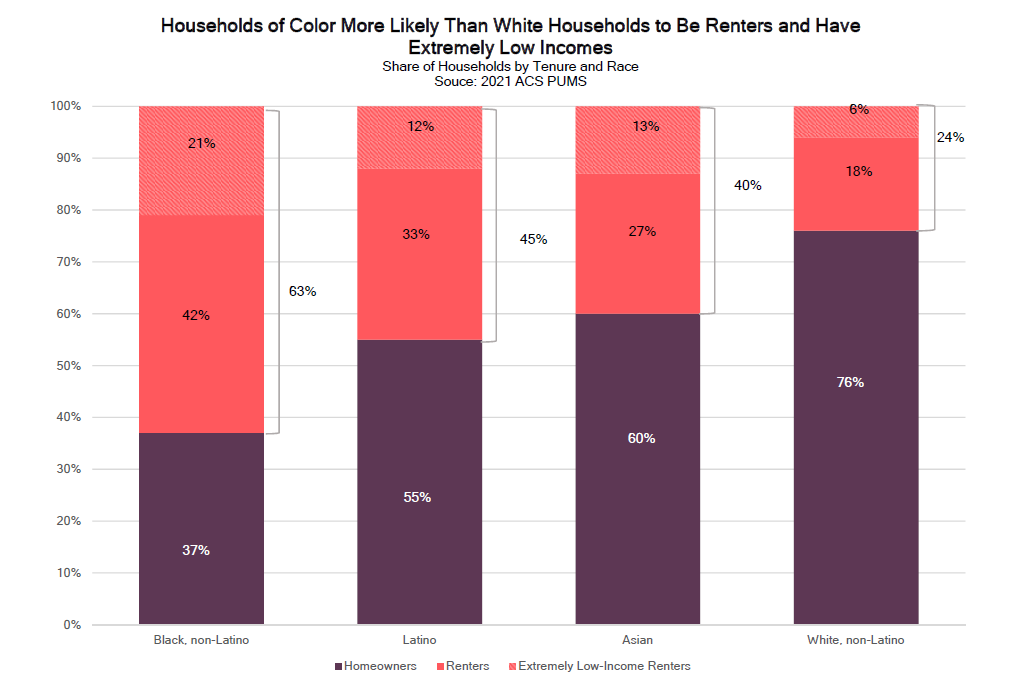

The burden of Indiana’s gap in affordable and available rental housing is disproportionately borne Black and brown Hoosier households, as these households are both more likely to be renters and to have extremely low incomes. They are twice or more as likely as white households to be extremely low-income renters. For example, 63% of Black households are renters and 21% are extremely low-income renters. 45% of Latino households are renters and 12% are extremely low-income renters. In contrast, 24% of white households are renters and 6% are extremely low-income renters. These disparities are the product of historical and ongoing injustices that have systematically disadvantaged Hoosiers of color, often preventing them from owning a home and significantly limiting wealth accumulation. These disparities also mean that Indiana’s policy choice to not allow enforcement of habitability standards further disproportionately puts the health and economic burdens of substandard housing on Black and brown Hoosier renter households.

And while Indiana is commonly thought of as an affordable place to live regarding the availability and cost of housing, this reputation does not bear out for the lowest-income Hoosiers who face housing shortages and high rates of housing cost burden. And while the Midwest is typically more affordable than heavily populated coastal areas, within the region Indiana performs below average. Indiana has a lower rate of affordable and available housing for ELI households at 39.3% than six other Midwest states, and below the average of 41% for states in the region. And Indiana’s rate of 70.5% of ELI households experiencing severe cost burden is higher than seven Midwest states and is higher than the 68.7% average for states in the region.

The Gap in Affordable Housing is Most Prominent for the Lowest-Income Households in all 92 Indiana Counties

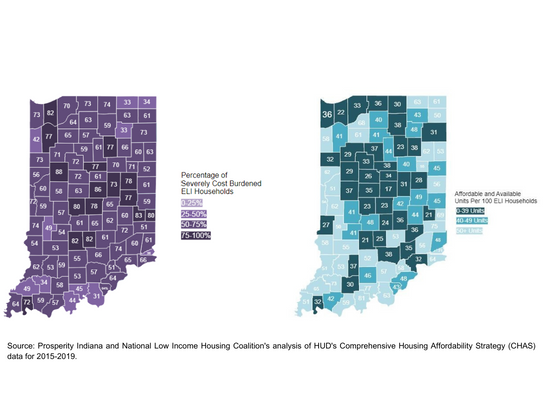

Additional analysis by Prosperity Indiana of the most recent county-level data (via HUD’s Comprehensive Housing Affordability Strategy data released in September 2022) finds that the state’s housing affordability gap and housing cost burden is truly statewide, but is consistently concentrated among the state’s lowest-income renter households. In all 92 Indiana counties, the rate of affordable and available rental housing is lowest for households making 0-30% of the county’s Area Median Income. And in 22 counties, the rate of affordable and available housing for the lowest-income renters is actually below the national average of 33 units for every 100 ELI households, including rural (Benton, Brown, and White), urban (Allen, Marion, and Vanderburgh), and suburban/mixed (Hamilton, Hendricks, and Porter).

See a table of the rates of affordable and available housing and housing cost burden for all 92 Indiana counties here.

.png)

In addition, in all 92 Indiana counties the rate of severe housing cost burden among extremely low income households was higher than the rate of severe housing cost burden among all other income categories combined. 21 counties have rates of severe housing cost burden above the national average of 72% for ELI households, including rural (Benton, Jennings, and Union), urban (Vigo, Lake, and St. Joseph), and suburban/mixed (Elkhart, Howard, and Wabash).

.png)

“Despite an improving state and national economy, this year’s Gap report finds that Indiana is making far too little progress to increase the supply, affordability, and habitability of housing to meet demand in all 92 counties. This new report shows the gap in affordable housing in Indiana is heavily borne by the lowest-income and most vulnerable Hoosier households,” said Prosperity Indiana Policy Director Andrew Bradley. “Indiana remains below average in the Midwest for the rate of affordable and available housing for extremely low income households, and higher than average for the rate of severe housing cost burden for those households. Indiana’s policymakers at the state, federal, and local levels must take advantage of every opportunity to focus efforts on increasing the supply of deeply affordable units; increasing funding for preserving the stock of existing affordable housing; and preventing the artificial depletion of supply by strengthening the enforcement of habitability standards,” Bradley said.

“As this year’s Gap report makes clear, extremely low-income renters are facing a staggering shortage of affordable and available homes,” said NLIHC President and CEO Diane Yentel. “In the wake of the pandemic, federal housing investments are more critical than ever for sustaining our communities and helping low-income people thrive. Yet House Republicans are now threatening to cut funding for the very programs that provide a lifeline to low-income renters. Balancing the national budget must not be done on the backs of our nation’s lowest-income and most marginalized people and families.”

For additional information, visit: http://nlihc.org/gap and https://www.prosperityindiana.org/

###

About Prosperity Indiana

The Indiana Association for Community Economic Development d/b/a Prosperity Indiana builds a better future for our communities by providing advocacy, leveraging resources, and engaging an empowered network of members to create inclusive opportunities that build assets and improve lives. Since its founding in 1986, Prosperity Indiana’s network has grown to nearly 200 organizations, representing thousands of practitioners statewide from the public, private, and nonprofit sectors.

About the National Low Income Housing Coalition

The National Low Income Housing Coalition is dedicated to achieving racially and socially equitable public policy that ensures people with the lowest incomes have quality homes that are accessible and affordable in the communities of their choice. NLIHC educates, organizes, and advocates to ensure decent, affordable housing for everyone. For more information about NLIHC, please visit www.nlihc.org.