Proposal to Eliminate Income Tax Would Worsen Regressivity

INDIANAPOLIS, Ind. January 9, 2024 — Indiana’s tax system is upside-down, with the wealthy paying a far lesser share of their income to tax than low- and middle-income families. And eliminating the state income tax would widen this disparity. That’s according to the latest edition of the Institute on Taxation and Economic Policy’s Who Pays?, the only distributional analysis of tax systems in all 50 states and the District of Columbia, co-released for Indiana by Prosperity Indiana, the Indiana Community Action Poverty Institute, the Indiana Assets & Opportunity Network, and the Indiana Coalition for Human Services.

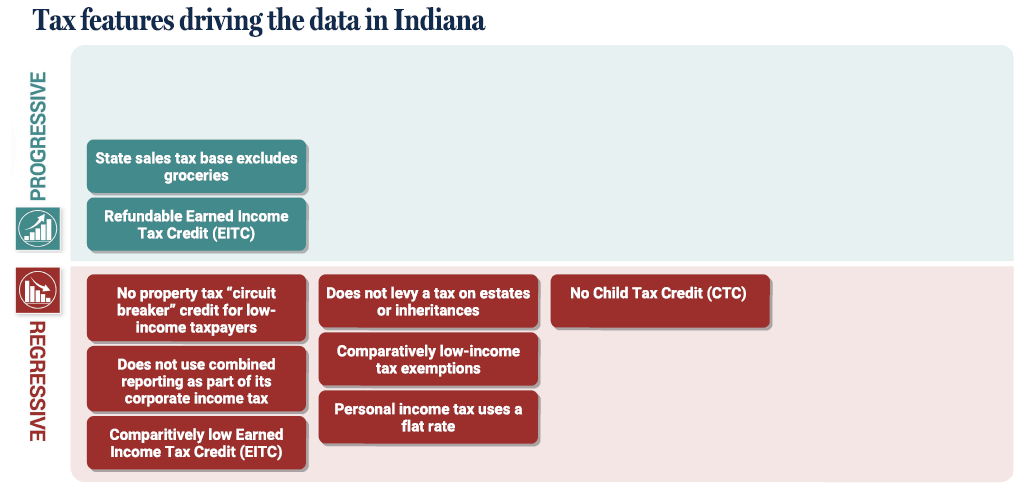

This regressivity in Indiana’s tax code is largely driven by heavy reliance on sales, excise, and property taxes that put a disproportionately large burden on low- and middle-income Hoosiers, combined with a flat income tax structure and relatively few tax credits to lessen the lopsided effect on the lowest-earning households. Lawmakers could help fix this imbalance by:

-

strengthening Indiana’s existing Earned Income Tax Credit;

-

introducing features to lessen the burden on the most vulnerable households, including a Child Tax Credit and a property tax ‘circuit breaker’ credit for low-income taxpayers; and

-

reversing previous policies (and avoid future choices) that have made Indiana’s state and local tax system the 14th-most regressive in the nation and 3rd-most regressive in the Midwest.

“This new edition of ‘Who Pays?’ comes at a key moment when Indiana policymakers are considering sweeping changes to the state’s tax system,” said Andrew Bradley, Policy Director for Prosperity Indiana and Board President of the Indiana Coalition for Human Services. “The state partners who have co-released this report share a similar vision of an Indiana where all Hoosiers have equitable access to economic and social opportunity and work every day to empower Hoosiers striving to reach their full potential. All state partners have included improving the equity of Indiana’s tax system in their 2024 policy agendas. Unfortunately, ‘Who Pays?’ makes it clear that Indiana’s current tax system acts as a barrier to economic opportunity for the low- and middle-income Hoosiers who bear the brunt of Indiana’s tax code, which is the 3rd-most regressive in the Midwest, and puts the 2nd-highest tax burden on the lowest earners in the region,” Bradley said. “To reverse Indiana’s regressive path, policymakers should:

-

first, do no harm by avoiding new regressive features or limits on ability to raise state and local revenue needed for community economic development and essential human services;

-

consult with those who work closest with the Hoosiers most burdened by the current upside-down state and local tax structure (such as the state partners co-releasing this report); and finally,

-

act to address regressive tax features identified in ‘Who Pays?’ (i.e. Indiana’s lack of a Child Tax Credit and property tax circuit breaker for low-income taxpayers) and re-imagine how Indiana’s tax and budget structure can work together to unlock the potential of all Hoosiers by fully funding needed services.”

"Everyone should contribute their fair share to ensure that we can invest in things like driveable roads, quality schools, and effective police and fire services – the things we need to prosper. When those who make the most pay the least, our tax code contributes to the financial hardships that hold Hoosiers back and shortchanges our potential to build thriving communities,” said Erin Macey, PhD, Director of the Indiana Community Action Poverty Institute and Co-Chair of the Indiana Assets and Opportunity Network. “Let’s close loopholes and make our tax code more just so we can all have the quality of life we deserve.”

The report’s key findings for Indiana:

-

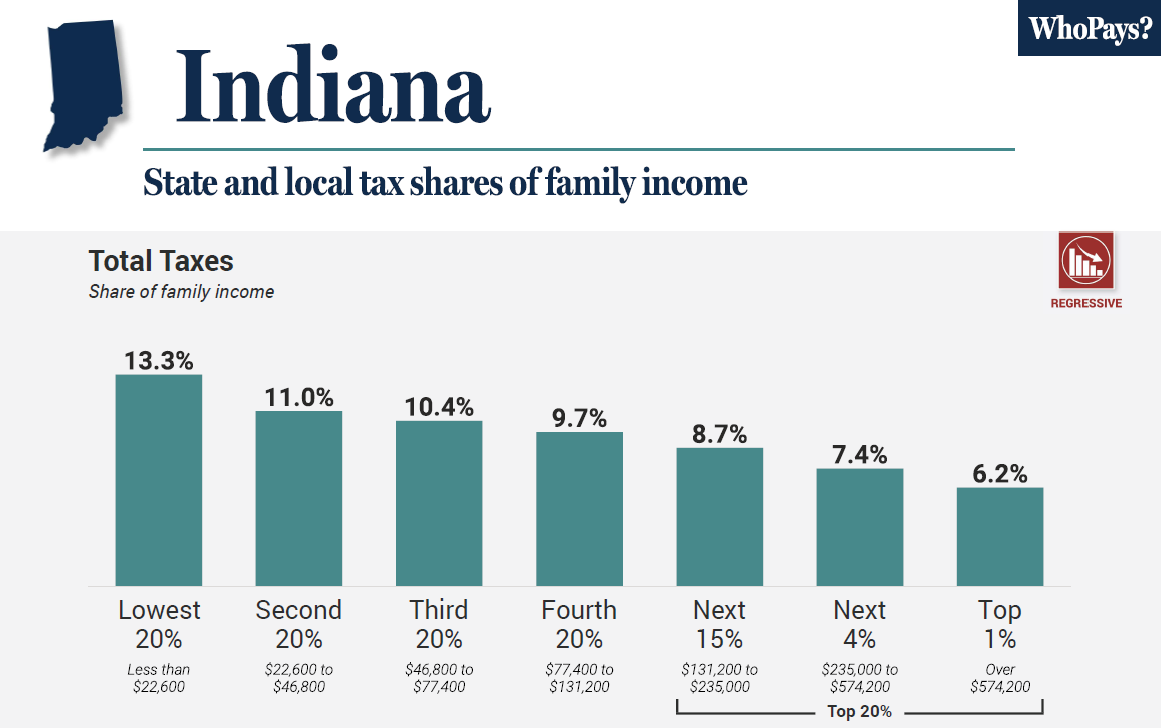

The lowest-income 20 percent of taxpayers face a state and local tax rate that is 115 percent higher than the top 1 percent of households. The average effective state and local tax rate is 13.3 percent for the lowest-income 20 percent of individuals and families, 10.4 percent for the middle 20 percent, and 6.2 percent for the top 1 percent.

-

Indiana has the 14th most regressive tax system in the nation, and 3rd most-regressive in the Midwest.

-

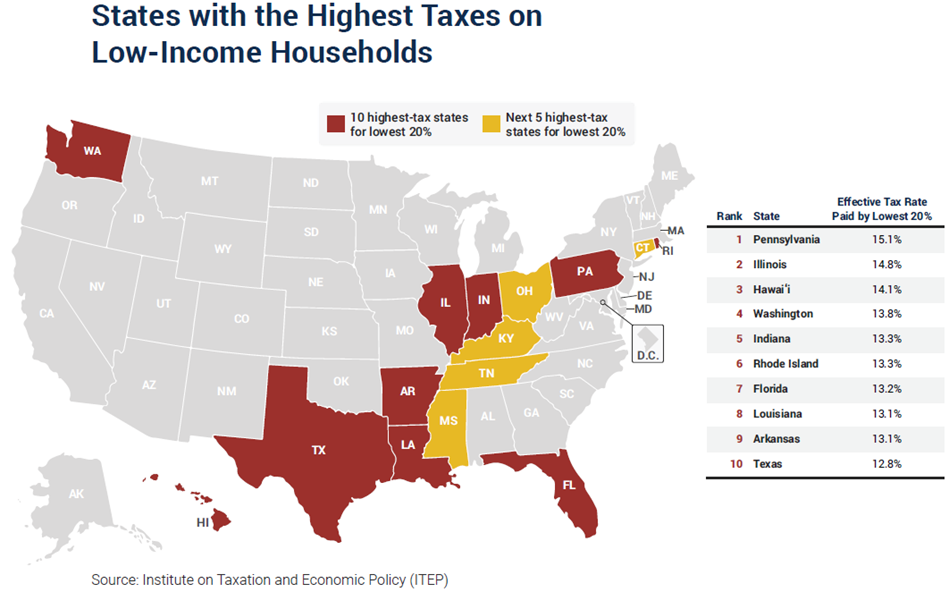

Indiana has the 5th-highest effective tax rate paid by the lowest-income 20 percent of earners, and 2nd highest in the Midwest.

-

Indiana is one of 42 states that tax the top 1 percent less than every other income group, and one of 35 states that tax their poorest residents at a higher rate than any other group.

-

Eliminating the state income tax would exacerbate this inequity, making the state drop to the 9th most regressive. Under this scenario, the lowest-income 20 percent of taxpayers would face a state and local tax rate that is 213 percent higher than the top 1 percent of households.

Nationally, tax systems in 44 states exacerbate inequality by making incomes more unequal after collecting state and local taxes, while systems in six states plus D.C. reduce inequality, the report finds. On average across the country, the lowest-income 20 percent of taxpayers face a state and local tax rate nearly 60 percent higher than the top 1 percent of households. The nationwide average effective state and local tax rate is 11.3 percent for the lowest-income 20 percent of individuals and families, 10.5 percent for the middle 20 percent, and 7.2 percent for the top 1 percent.

|

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that,” says Carl Davis, ITEP’s Research Director. “There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Nationwide, recent policy changes have exacerbated or lessened regressivity in state tax systems, depending on the choices made by lawmakers.

Many states with tax codes that already increase inequality have doubled down on regressive tax policies in recent years. Arkansas, Idaho, Iowa, Kentucky, Nebraska, and West Virginia, for instance, have taken steps to deeply cut taxes on more affluent households and wealthy corporations.

On the other hand, many of the states with tax codes that reduce inequality, or at least do less than average to widen inequality, have made strides toward more progressive tax policies in recent years. Massachusetts, Minnesota, New Jersey, New Mexico, New York, and the District of Columbia, for instance, have taken steps both to raise taxes on more affluent households and lower them for low- and moderate-income families.

“We’ve seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest. But we know it doesn’t have to be like this. There is a clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off,” said Aidan Davis, ITEP’s State Policy Director. “The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.”

|

|

###

|

|

About the report:

Who Pays? is the only distributional analysis of tax systems in all 50 states and the District of Columbia. The comprehensive 7th edition of the report assesses the progressivity and regressivity of state tax systems by measuring effective state and local tax rates paid by all income groups. No two state tax systems are the same; this report provides detailed analyses of the features of every state tax code. It includes state-by-state profiles that provide baseline data to help lawmakers and the public understand how current tax policies affect taxpayers at all income levels. Over 99 percent of all state and local taxes, measured by their revenue contribution, are included in the analysis.

About ITEP:

ITEP is a non-profit, non-partisan tax policy organization. We conduct rigorous analyses of tax and economic proposals and provide data-driven recommendations on how to shape equitable and sustainable tax systems. ITEP’s expertise and data uniquely enhance federal, state, and local policy debates by revealing how taxes affect people at various levels of income and wealth, and people of different races and ethnicities. Visit the ITEP website at https://itep.org/.

About State Groups:

Prosperity Indiana is a not-for-profit 501(c)3 organization formed in 1986 as the Indiana Association for Community Economic Development. PI is a network of approximately 200 organizations and individual members committed to advancing community economic development through our values of eliminating barriers, ensuring everyone has better opportunities to pursue the American Dream and prosperity for all. Visit the Prosperity Indiana website at www.prosperityindiana.org and follow @ProsperityInd on Twitter.

The Indiana Community Action Poverty Institute is a program of the Indiana Community Action Association. Indiana’s 22 Community Action Agencies provide over 70 programs & services help Hoosiers throughout Indiana achieve and maintain financial well-being.

The Indiana Assets & Opportunity Network (A&O) connects and provides learning opportunities to practitioners and advocates committed to asset building. It is co-governed by Prosperity Indiana and the Indiana Community Action Poverty Institute and has a Steering Committee of diverse organizations that support an economy that works for all Hoosiers. Members of the A&O Steering Committee are leaders in the Indiana asset-building space. Visit the A&O website at www.indianaopportunity.net.

The Indiana Coalition for Human Services (ICHS) is a nonpartisan coalition of advocacy and human service organizations that engages, educates and mobilizes decision-makers, its stakeholders and the public on fact-based, equitable public policies resulting in quality outcomes for all Hoosiers. Collectively, we are Indiana’s trusted expert on fact-based, equitable public policies that empower Hoosiers striving to reach their full potential. Visit the ICHS website at https://ichsonline.net/.

Media Contact: Andrew Bradley, Policy Director at Prosperity Indiana, abradley@prosperityindiana.org | Jon Whiten at ITEP, jon@itep.org

|