In Congress, two new legislative initiatives have been introduced that aim to alleviate cost burdens for low-income renters. These bills come on the heels of new data showing that In only 22 counties out of more than 3,000 nationwide can a full-time minimum wage worker afford a one-bedroom rental home at fair market rent. These 22 counties are all located in states with hourly minimum wages higher than $7.25. Further, since 1960, median earnings increased 5% while rents rose 61% and despite increasing need, only one out of every four very low-income renter households, those at or below 50% AMI, receives housing assistance.

In Congress, two new legislative initiatives have been introduced that aim to alleviate cost burdens for low-income renters. These bills come on the heels of new data showing that In only 22 counties out of more than 3,000 nationwide can a full-time minimum wage worker afford a one-bedroom rental home at fair market rent. These 22 counties are all located in states with hourly minimum wages higher than $7.25. Further, since 1960, median earnings increased 5% while rents rose 61% and despite increasing need, only one out of every four very low-income renter households, those at or below 50% AMI, receives housing assistance.

In Indiana, a minimum wage worker must have 2.1 full-time jobs or work 86 hours per week to afford a two-bedroom apartment. According to calculations based on census data, there is a deficit of 134,998 units affordable and available for extremely low-income Hoosiers earning 30 percent of area median income or below. With that in mind, we take great interest in new initiatives to help address this housing crisis.

Rent Relief Act

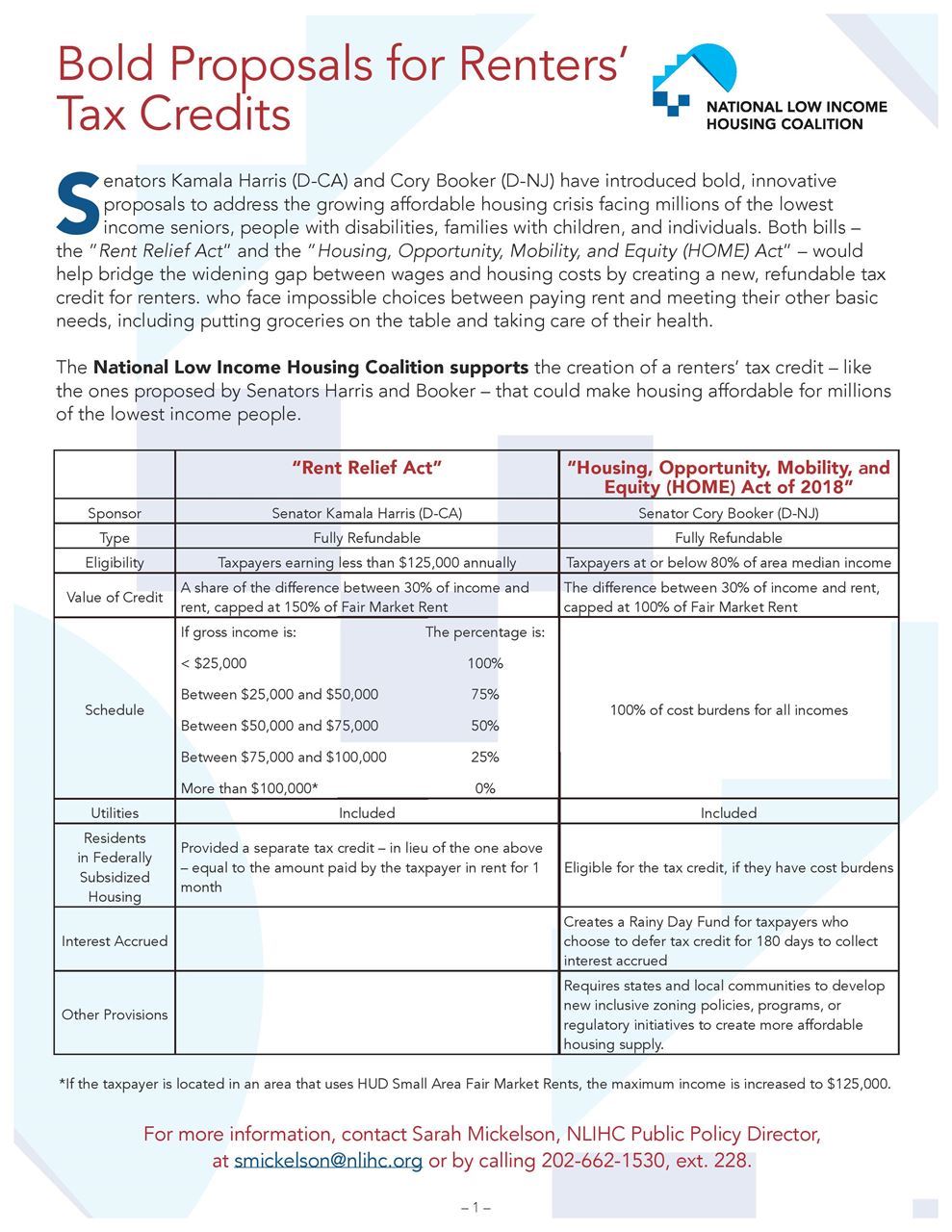

On July 19, Senator Kamala Harris (D-CA) introduced the Rent Relief Act, to provide relief to cost-burdened renters by proposing a refundable tax credit to individuals who pay more than 30 percent of their gross income toward rent and utilities. Taxpayers earning less than $100,000 annually, or $125,000 in high-rent areas, would receive a credit that would cover the difference in rental payments between 30 percent of the taxpayer’s income and rent, capped at 150 percent of fair-market rent. Renters in subsidized housing would be able to claim one month’s rent as a refundable credit.

Housing, Opportunity, Mobility, and Equity Act

Soon after, on August 1, Senator Booker (D-NJ) introduced the Housing, Opportunity, Mobility, and Equity Act (HOME) Act that would also provide a refundable tax credit to households who spend more than 30% of their income on rent. The credit would apply to renters earning 80 percent of area median income and would be capped at 100 percent of fair market rent. The HOME Act would also allow renters to defer 20 percent of their tax credit to a rainy day savings program to help cover emergency expenses. Importantly, Sen. Booker’s bill also address the need for the expansion of affordable housing units by requires states and local communities to develop new inclusive zoning policies, programs, or regulatory initiatives to create more affordable housing supply.

- Below are best practices the bill proposes communities adopt:

- Reduce barriers to housing development, including affordable housing.

- Authorizing high-density and multifamily zoning.

- Eliminating off-street parking.

- Establishing density bonuses.

- Removing height limitations.

- Prohibiting source of income discrimination.

- Relaxing lot size restrictions.

- Allowing accessory dwelling units.

Below is a comparison chart for both bills