On the heels of the release of the 2019 Out of Reach report, several media outlets took note and ran stories that lift up why this housing wage data is so critical and why our advocacy work to expand the supply of affordable housing is essential to ensuring more Hoosiers have the opportunity to prosper. Below are the highlights:

Televised News:

Russ McQuaid - Fox59: Study shows affordable housing remains out of reach for many Hoosiers

POSTED 4:33 PM, JUNE 18, 2019, BY RUSS MCQUAID, UPDATED AT 06:59PM, JUNE 18, 2019

INDIANAPOLIS, Ind.-- A woman who didn’t want to give her name explained what it cost to live at the Maple Creek Apartments on West Michigan Street west of Haughville.

“It's $628 a month,” she said. “I make about $900 gross a month.”

That's two-thirds of her money going to rent. How does she pay for clothes, electricity and food?

“It's very hard. I’m a single mother,” she said. “I get my bills aside and I calculate them all up and pay what’s important and what’s not important I leave to the side and pay’s over.”

The anonymous mom is one of tens of thousands of Hoosiers that a new study finds can’t afford to live in suitable housing at a reasonable rate.

“Out of Reach: The High Cost of Housing," a study released jointly by Prosperity Indiana and The National Low Income Housing Coalition, reported a worker must earn $16.02 an hour to afford a modest two-bedroom apartment or a minimum wage employee must work 88 hours a week to pay the rent in a comparable unit.

“Data shows that the typical renter income is insufficient to afford rental housing in 82 of Indiana’s 92 counties,” said Jessica Love, Prosperity Indiana’s Executive Director. “For Hoosiers working full-time at minimum wage, there is a monthly deficit of over $450 to afford the state average fair market rate for a modest two-bedroom unit.”

A Prosperity Indiana statement quotes Love as calling for “an urgent need for action in implementing common-sense solutions at the federal and state level to address our affordable housing crisis.”

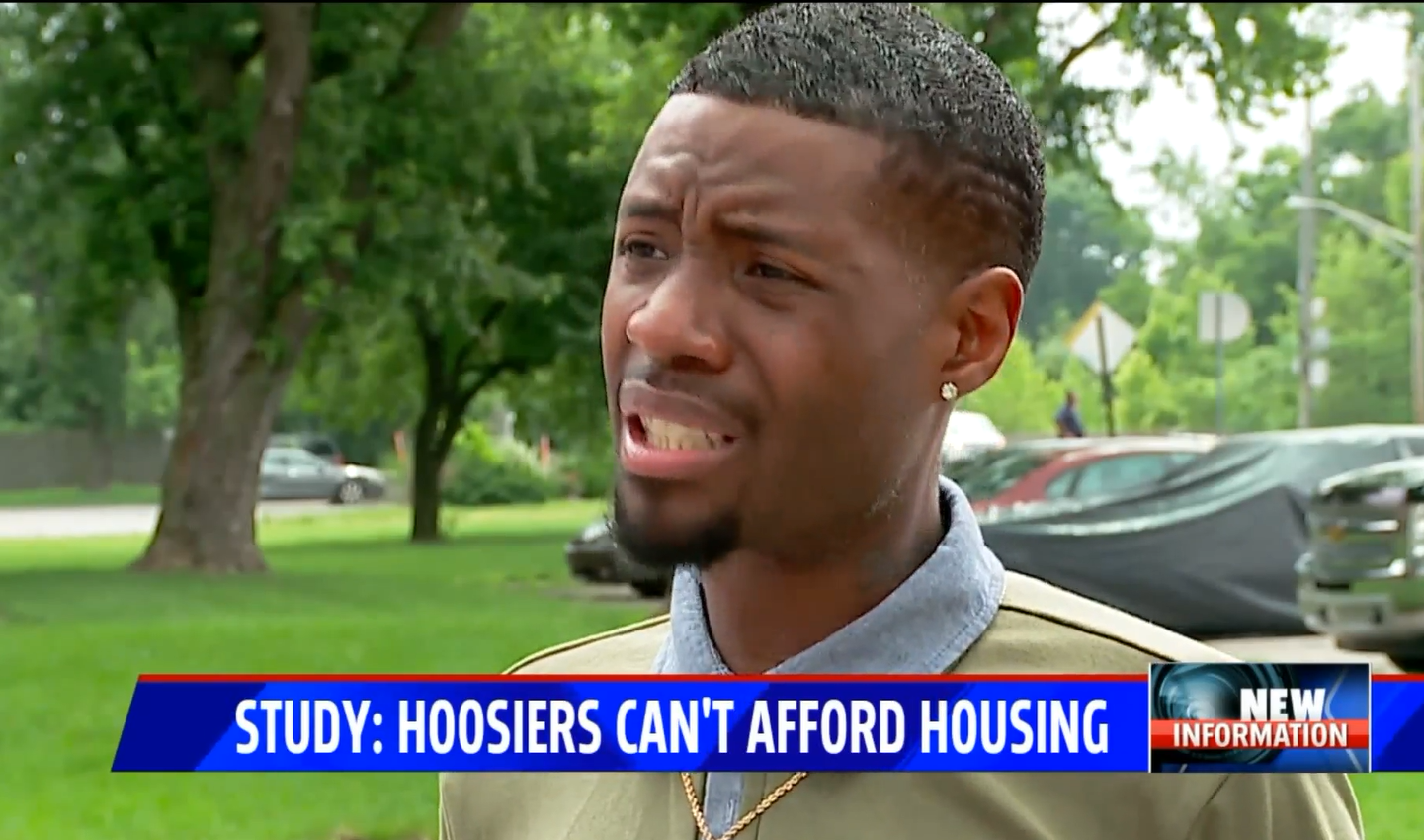

Derrick Maxwell is a former leasing agent at Maple Creek who stayed on a resident.

“Some of the residents are on Social Security, most retired vets and things like that, they don’t have the means because they’re set on a steady income and I feel like they should not be ostracized because they are on a fixed income,” said Maxwell who estimates he pays a quarter of his monthly income in rent. “There’s not a lot of jobs here in Indianapolis that are…or maybe these people don’t have the type of skill settings and training to make those type of jobs and make that money so it's kind of hard and you’re forced to live in areas where you would prefer not to be in because you only meet their income limit.”

Back east along West Michigan Street at White River Parkway, work continues on the Riverview Apartments, a complex developed by Goodwill and Strategic Capital Partners.

“It's targeted to families with incomes of $40-60,000 and really those that focus in that area,” said Goodwill Vice President Cindy Graham. “When we started to take a look at what was happening in the Indianapolis rental market and seeing that some of those people that are in those mid-level jobs like nursing, teachers, firemen, policemen, are really getting priced out of the fair market pricing market in the downtown area, yet their services are still needed.”

The one- and two-bedroom apartments will rent for an average of $1.35 per square foot, about ten percent less than the average rental costs in downtown.

“You would be surprised to know that Goodwill has teachers,” said Graham. “We operate 14 adult high schools and a traditional school right here on this property and we have nurses who work for us, too, so we actually have employees who would qualify for workforce housing.”

Market analysts report downtown Indianapolis’ residential rental occupancy rate is 93%, down three percent from a couple years ago, as the Mile Square is set to absorb another 1300 new rental units coming on line in 2019.

Back at Maple Creek, the woman who feared that revealing her name would anger the landlord said she had good reasons to cut corners in order to keep a roof over her family’s heads.

“If you don’t have a house, your kids gonna go to the State and you’re gonna be homeless,” she said, “and I don’t want to be homeless.”

Print Media/ Radio:

Study: SEI Renters' Incomes Not Enough To Afford Decent Place

By Mike Perleberg

A new report found the cost of remaining stably housed continues to rise for average Hoosier renters in most Indiana counties. Decent housing is out of reach for low-wage workers in every county of the state.

(Lawrenceburg, Ind.) - A new study says rents are unaffordable for low-wage workers in southeastern Indiana, as well as most of the state.

The report - Out of Reach: The High Cost of Housing - from Prosperity Indiana and the National Low Income Housing Coalition says that in order to afford a modest, two-bedroom apartment at fair market rent on $834 in Indiana, a household must earn $2,779 monthly – or about $33,346 annually. The needed pay figure is up from last year’s study.

With almost a third of households statewide being rented, data shows that typical renter income is insufficient to afford rental housing in 82 of the state’s 92 counties. Included in that list are Dearborn, Franklin, Ohio and Ripley counties, where estimated average renter wages are among the lowest in the state.

The study suggests renters in southeastern Indiana have to work more than one 40-hour week job at the average renter wage in order to have enough money to afford a decent two-bedroom unit. For those making the state minimum wage of $7.25, paying the monthly rent is almost impossible.

In the Cincinnati area, the annual income needed to afford such an apartment is higher at $35,360 than Indiana. About 21 percent of homes in the area are rentals.

“For Hoosiers working full-time at minimum wage, there is a monthly deficit of over $450 to afford the state average fair market rate for a modest two-bedroom unit,” said Jessica Love, Prosperity Indiana’s executive director.

Conservative figures cited in the study show that nearly 32,000 households statewide are evicted each year. With an affordable housing deficit of 134,485 units in Indiana, low-income earners have few options.

Love believes there is “an urgent need for action in implementing common-sense solutions at the federal and state level to address our affordable housing crisis.”

Indiana U.S. Senator Todd Young and others in the Senate last week introduced the HUD Manufactured Housing Modernization Act of 2019. The federal legislation is aimed at improving access to safe and stable housing would provide new support for state and local governments wishing to include manufactured homes as a solution.

“Solving the housing affordability crisis for Hoosiers of all income levels is going to require bold and innovative changes to our nation’s housing policies,” said Young. “With over 2.5 million Hoosiers already living in manufactured homes — and with Hoosier workers leading the way in construction of manufactured housing — I know it’s time to put greater emphasis on manufactured housing as a housing affordability solution.”

Another bill by Young, S. 1772, would establish a task force to assess the impact of the affordable housing crisis and identify possible solutions.

Rental housing needs have worsened considerably over the past 30 years since Out of Reach was first released. Diane Yentel, president and CEO of the National Low Income Housing Coalition, says that although housing is out of reach for millions of low-wage workers, members of Congress are starting to take note.

“Big, robust housing bills have been introduced by key policymakers. The topic of affordable housing is becoming increasingly prevalent on the 2020 presidential campaign trails. We now have a tremendous opportunity to implement bold federal housing policy solutions that will fund affordable housing programs at the scale necessary,” said Yentel.