Prosperity Indiana's policy team is already hard at work in the halls of the Statehouse trying to advance critical priorities. To read our 2017 policy agenda and state policy priorities,

click here. We hope our members will join our advocacy efforts by attending our Statehouse Day on Tuesday, Jan. 31

st. For more information and to RSVP,

click here.

This blog will elaborate on progress already underway in working towards our 2017 state advocacy goals below, but as we referenced in our 30th Anniversary and Prosperity Indiana Summit policy sessions, it is important to understand the context of broader policy priorities dominating legislators’ attention.

Top General Assembly Priorities from Legislative Leaders

House Agenda:

House leaders unveiled their top priorities for this session during Organization Day last November. The plans were elaborated on in the House Republican’s “Investing In Our Future Plan.” Speaker Brian Bosma has outlined the following as the key focus for House leadership:

- Passing a balanced state budget

- Passing a 20-year infrastructure plan, including a gas tax increase, new special fuel and motor carrier surcharges, and a new annual fee on all vehicles to address the more than $1 billion in additional funding per year needed to maintain roads and bridges

- Expanding education opportunities – while not favoring a universal expansion of pre-k, the Speaker did express support for expanding Indiana’s existing pre-k pilot program and for improving testing in the state’s classrooms

- Expanding job creation and workforce development- the Speaker referenced the Department of Workforce Development’s estimate that the state will need to fill 1 million jobs by 2022. He pledged that House members will advance policies to meet the training and educational needs to fit employee/employer needs.

- Addressing the opioid and heroin epidemic and public safety needs- Speaker Bosma committed to focusing on “efforts to expand substance abuse and treatment options.” He also called for an increase in Indiana State Police salaries.

Senate Agenda:

January 10, Senate leadership unveiled their agenda, which largely mirrors priorities of their House counterparts with some minor additions and some differences in their approach. Senate President Pro Tem David Long listed the following as specific priorities:

- Passing another balanced, two-year state budget

- Creating a long-term road funding plan – Sen. Long would not commit to a specific figure on how much taxes should be increased to pay for roads, but did indicate the Senate would start to work with the House blueprint and identify new sources of funding.

- Passing a balanced budget amendment that would “prohibit state spending from exceeding state revenue unless two-thirds of the General Assembly deems it necessary to use emergency spending measures”

- Fighting opioid abuse through prevention, enforcement, treatment and data collection measures

- Addressing educational needs by replacing the ISTEP exam, improving career and technical education in the school funding formula, and fixing the overall structure of workforce development

- Fixing Indiana’s e-liquids law by reforming regulations for e-liquids manufacturers

Top Administrative Priorities

On Monday January 9, Governor Eric Holcomb and Lt. Governor Suzanne Crouch were sworn in during inaugural ceremonies. Last week, however, on January 5, then Governor-elect Holcomb and Lt. Governor-elect Crouch unveiled their Next Level 2017 Agenda. The proposals referenced a number of the key legislative priorities put forth by legislative leaders and include some additional ideas. Those proposals include:

- Investing $1 Billion to make Indiana an innovation hub over the next 10 years through investments in high-growth early stage and mid-cap Indiana companies, continue resources for the Regional Cities program, and creating entrepreneurship grants to support programs and partnerships with Indiana higher education institutions and communities

- Creating a 20-year plan to fund roads and bridges, mirroring on legislative leaders’ plans

- Improving workforce readiness, which includes an appointed Secretary of Education beginning in 2021 to replace the Superintendent of Public Instruction, as well as doubling the state’s investment in pre-kindergarten

- Addressing the drug epidemic by creating the position of Executive Director for Substance Abuse Prevention, Treatment, and Enforcement in the Governor’s office, giving local officials the authority to establish syringe exchange programs, limiting controlled substance prescriptions and refills, and enhancing penalties for pharmacy robberies

- Improving government service by modernizing the state Department of Revenue computer system, raising pay for Indiana State Police, upgrading Indiana State Police labs, analyzing waste, fraud and abuse in Indiana’s Medicaid and unemployment insurance programs, exempting military pensions from the state income tax, and expanding the nurse-family partnership to combat infant mortality.

Top Prosperity Indiana Priorities

As referenced above, the Prosperity Indiana public policy team, which includes Kathleen Lara, Andy Fraizer, Steve Hoffman (the President Prosperity Indiana’s Board of Directors and the Public Policy Committee Chair), and Ice Miller, LLP representatives (Prosperity Indiana's lobbying partners), is already tracking and analyzing a number of bills to support and oppose in this legislative session and accordingly, meeting with legislators to advance and oppose a variety of legislative proposals.

For Prosperity Indiana’s comprehensive bill tracking list and link to more information about legislation, click here [Member Access]. This list is exhaustive of all introduced legislation that pertains to any Prosperity Indiana member issue area.

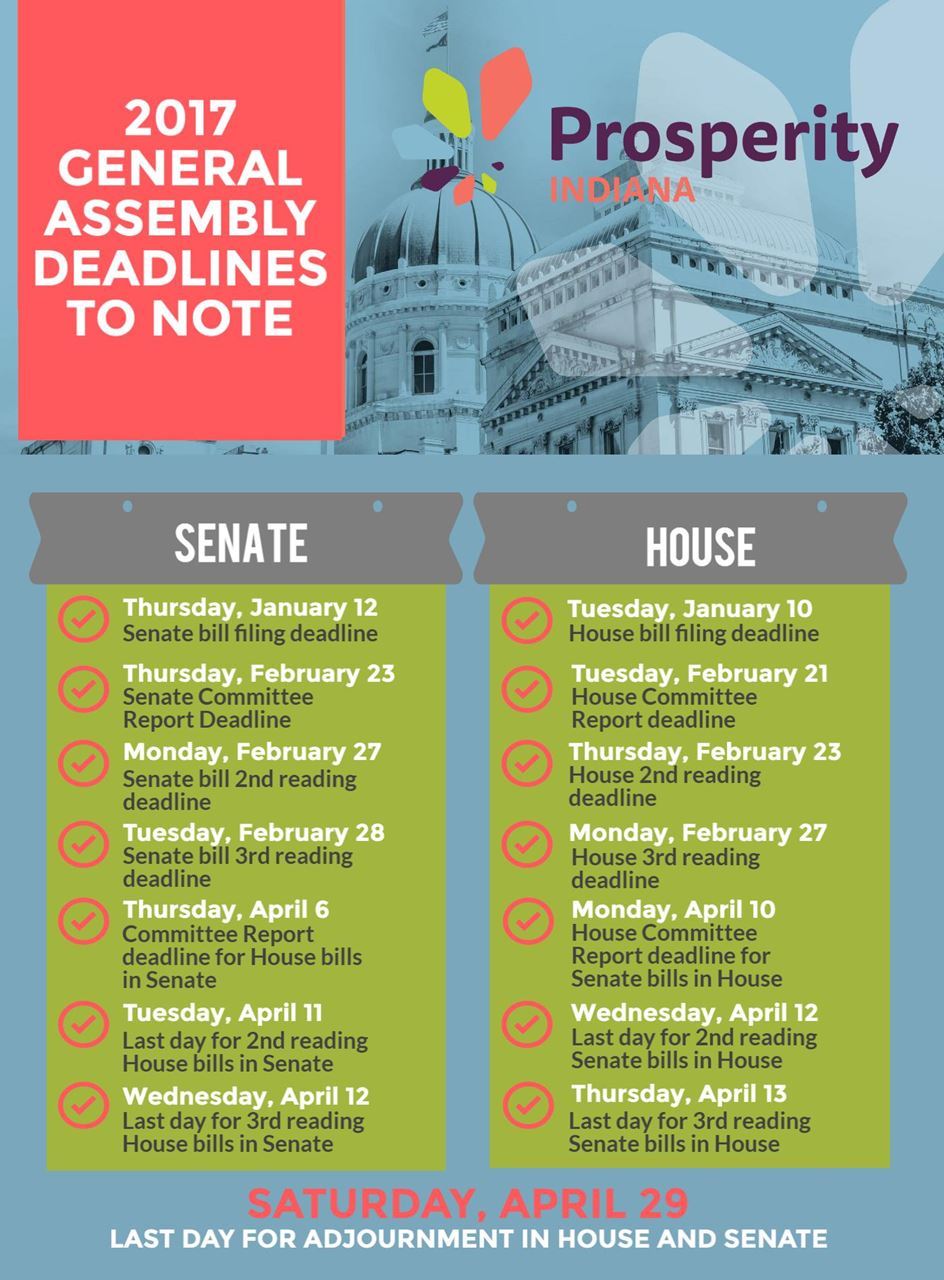

For a more refined review of key legislation in critical areas for members, review Prosperity Indiana’s top priority bill tracker by clicking here [Member Access]. The identified bills on that list are most likely to proceed at the State House or of greatest concern to Prosperity Indiana’s policy team. Please keep in mind that the deadline bill filing is Thursday, January 12, so our tracker information will be updated as additional bill information becomes available.

Prosperity Indiana has four key affirmative priorities for the 2016 Indiana General Assembly and one key area of defense thus far.

Affirmative Priorities:

- Clarifying Charitable Affordable Housing Property Tax Exemption:

SB 559 PROPERTY TAX EXEMPTION FOR AFFORDABLE HOUSING (Eckerty, D) - Provides a property tax exemption for affordable rental housing property when the property does not otherwise qualify for a property tax exemption. Provides that, in order to qualify for the exemption, the owner must meet the criteria applied by the Internal Revenue Service in determining if an organization that provides low income housing is considered charitable because it relieves the poor and distressed. Clarifying state code on property tax exemption for non-profit owned affordable housing. For background on this issue and a summary of the proposal to be introduced this session, click on the following one-pager summaries below.

Background on Property Tax Exemption Issue

Summary of Current Proposal

- Protecting Consumers, Promoting Economic Stability Through the Extension of the Foreclosure Filing Fee:

We have worked with two legislative leaders to introduce bills to extend the Foreclosure Filing Fee, which helps fund statewide foreclosure counseling training, extensive counseling services and court coordinator-assisted mortgage workouts for Indiana borrowers at risk of losing their homes. Those bills include:

-

- SB 227 FORECLOSURE COUNSELING AND EDUCATION FEE (Merritt, J) - Removes a provision providing for the July 1, 2017, expiration of the $50 mortgage foreclosure counseling and education fee that must be paid by a party filing an action to foreclose a mortgage.

- HB 1097 FORECLOSURE COUNSELING AND EDUCATION FEE (Burton, W) - Extends from July 1, 2017, to July 1, 2019, the date for the expiration of the $50 mortgage foreclosure counseling and education fee that must be paid by a party filing an action to foreclose a mortgage.

- Empowering Low-Income Hoosier Families Through the Removal of the Asset Limit Test for SNAP Eligibility:

SB 154 REMOVAL OF ASSET LIMITS FOR SNAP ELIGIBILITY (Merritt, J) - Requires the division of family resources to: (1) implement within the federal Supplemental Nutritional Assistance Program (SNAP) an expanded eligibility category, which does not consider an individual's value of assets in determining SNAP eligibility; and (2) notify the United States Department of Agriculture of the implementation of expanded categorical eligibility under SNAP.

This is critical to help low-income families as the current asset limit test disincentivizes savings, which is a critical step toward self-sufficiency.

- Empowering Low-Income Hoosier Families Through the Expansion of Pre-K Educational Opportunities:

One of our top state legislative priorities in 2017 is expanding economic opportunities for Hoosier families, including childcare resources and pre-k expansion for low-income households. As part of that effort, we are partnering with the All IN 4 Pre-K campaign. A number of bills have been introduced this session aimed at pre-k expansion and are included in our bill trackers, but Prosperity Indiana’s policy team is still examining those proposals before endorsing a specific approach. Stay tuned to this blog post for important updates.

Defensive Priorities:

- Protecting Consumers, Promoting Economic Stability Through Opposition to Predatory Lending Expansion:

SB 245: LONG TERM SMALL LOANS (Holdman, T) - Provides that a lender that is licensed by the department of financial institutions to engage in small loans may enter into a transaction for a long term small loan with a borrower. Defines a long term small loan as a loan that: (1) is entered into by a licensed small loan lender and a borrower; (2) has a principal amount of at least $605 and not more than $2,500; and (3) is payable in installments over a term of not more than 24 months. Provides that with respect to a long term small loan, a lender may contract for and receive a monthly loan finance charge that: (1) does not exceed 20% of the principal; and (2) is earned by the lender on a daily basis using the simple interest method.

One of Prosperity Indiana’s central 2017 advocacy priorities is preventing the predatory loan products and practices that disproportionately affect low-income consumers. That is precisely what SB 245 would do. The proposal offers a longer-term installment loan carrying interest rates rate exceeding 200% APR. For example, a $1,000 loan due in 6 months will carry a 230% APR and on a $2,500 loan due in 24 months, a borrower will pay back over $12,000. These rates are significantly higher than other installment loans already offered in Indiana and would hurt vulnerable consumers. Click on the summary one-pager below to learn more about the detrimental impact the proposal will have on low-income consumers.

SB 245, By the Numbers

Please stay tuned to our blog for critical action alerts and legislative updates as the 120th General Assembly session continues. Prosperity Indiana is grateful to our members for their work, advocacy, and partnership!