FOR IMMEDIATE RELEASE

June 14, 2023

Contact: Andrew Bradley | (317) 222-1221 x403 | abradley@prosperityindiana.org

"It feels like we are being set up to fail" - Affordable Housing is Out of Reach in Indiana for Low-Wage Hoosiers

by Erica Boswell and Andrew Bradley

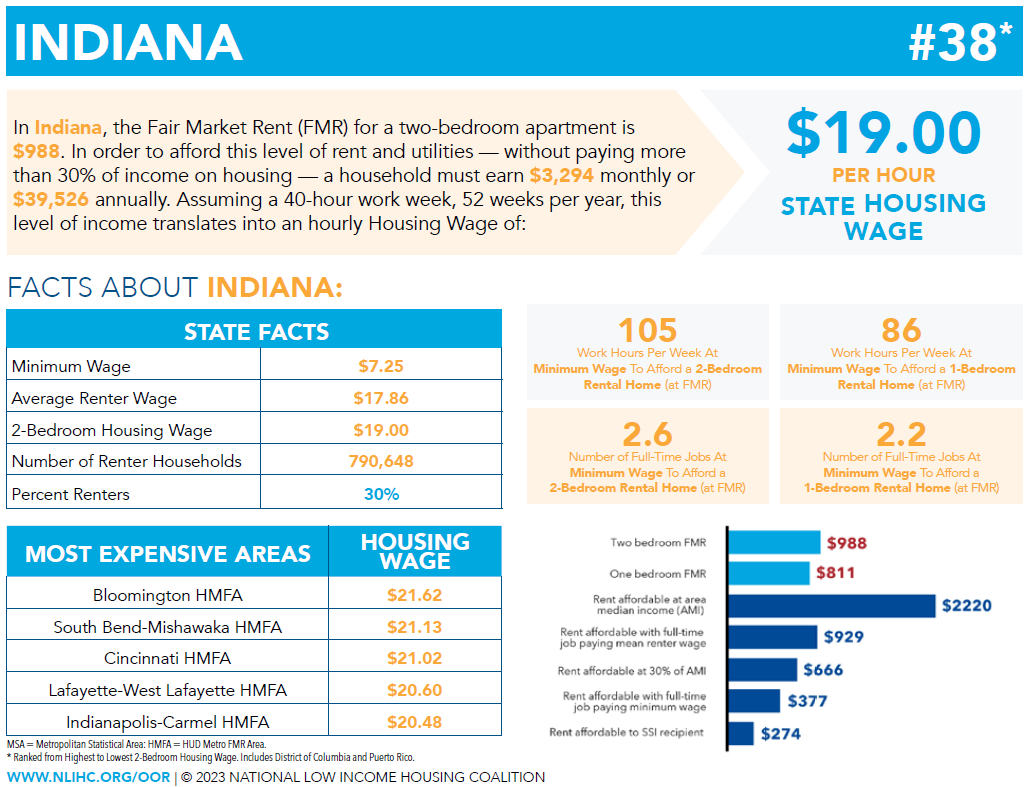

Full-time Hoosier workers need to earn $19.00 per hour to afford a modest, two-bedroom apartment at fair market rent. This is Indiana’s 2023 “Housing Wage,” according to a report published today by the National Low Income Housing Coalition (NLIHC) and Prosperity Indiana. The report finds that inflated rent in Indiana has fueled the increase in the state’s Housing Wage needed to afford housing costs, erasing any gains in Hoosier renters’ wages which remain persistently far below the Midwest average.

Released annually, the Out of Reach report calls attention to the gulf between wages and what people need to earn to afford their rents. The report shows that affordable rental homes are out of reach for millions of low-wage workers and other families. The report’s “Housing Wage” is an estimate of the hourly wage full time workers must earn to afford a rental home at fair market rent without spending more than 30% of their incomes. Nationally, the 2023 Housing Wage is $28.58 per hour for a modest two-bedroom rental home and $23.67 for a modest one-bedroom rental home.

While the Housing Wage varies by state and metropolitan area, low-wage workers everywhere – including in all 92 Indiana counties - struggle to afford their housing. “Indiana has twin crises of a shortage of affordable homes and too few good-paying jobs to afford them. This is a symptom of a lack of economic opportunity which prevents too many Hoosiers from achieving their true potential and leaves Indiana behind the curve of the Midwest,” said Andrew Bradley, policy director for Prosperity Indiana and board member of NLIHC.

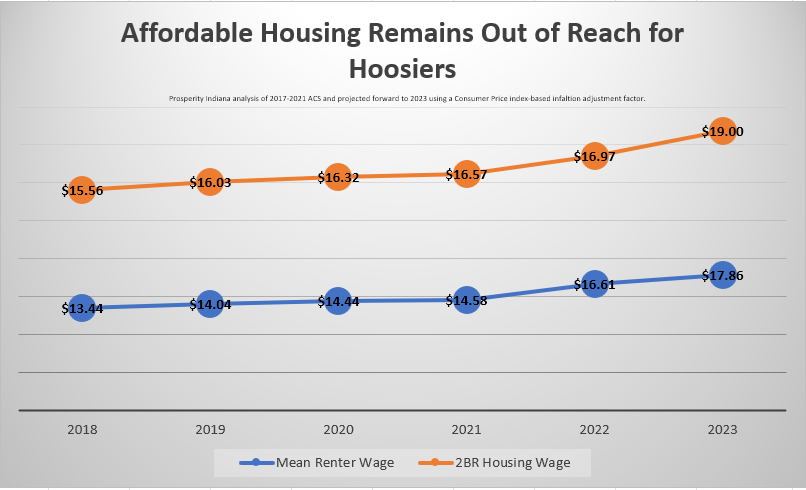

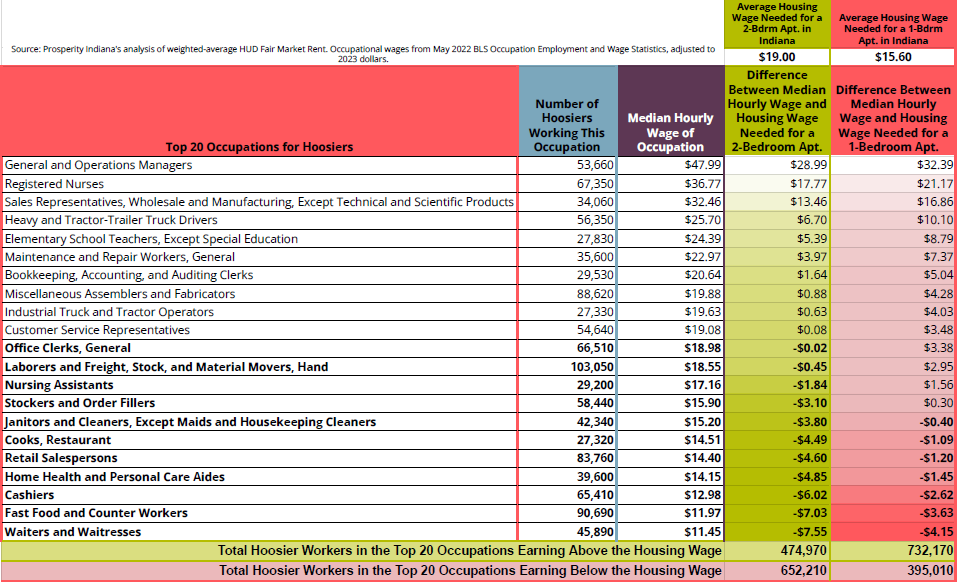

“The new Out of Reach 2023 report finds that while the Housing Wage needed to afford a modest two-bedroom home in Indiana increased by 12% over the past year, the average Hoosier renter’s wage increased by only 7.5%. The report also finds that 10 of Indiana’s top 20 largest occupations now don’t pay the state’s Housing Wage, up from nine just a year ago. This double squeeze of low pay and out-of-reach housing disproportionately harms Black and brown Hoosiers, families with children, and the state’s most vulnerable populations in urban, rural, and suburban communities alike.”

“To break out of this cycle of jobs that pay too little for housing that costs too much, Indiana needs to articulate a community development and economic development policy strategy that boosts the pay and quality of Indiana’s current jobs, builds pathways to better careers statewide, and increases the supply, access, and habitability standards for affordable housing in the places Hoosiers live,” Bradley said.

Even before the pandemic, low-income renters were facing a housing crisis, with rents increasing much more quickly than wages and federal assistance programs remaining underfunded. With the arrival of the pandemic, widespread job and wage losses followed by skyrocketing rents exacerbated the situation, putting new pressures on renters throughout the country. Though rent inflation has moderated in most markets and is now at pre-pandemic or even lower levels, rents remain too high for low-wage workers and other low-income renters. At the same time, pandemic-era benefit programs – like emergency rental assistance (ERA), additional allocations from the Supplemental Nutrition Assistance Program (SNAP), and childcare tax benefits – have ended. In consequence, the lowest-income renters are facing high rents without the support of those safety net programs that kept them stably housed during the pandemic, with the result that eviction filings are returning to or surpassing pre-pandemic levels in some communities.

Affordable Housing is Out of Reach in all 92 Counties while Indiana Remains Behind Midwest in Renter Wages

The new Out of Reach report finds that increases in rent have occurred in all parts of Indiana, but wages have not increased to keep up with housing costs or average wages in the Midwest. While the Housing Wage needed to afford a two-bedroom unit rose from $16.97 in 2022 to $19.00 in 2023, representing a 12% increase, Indiana’s average renter wage increased only 7.5%, from $16.61 in 2022 to $17.86 in 2023. The median renter wage in Indiana has consistently trailed the state’s Housing Wage in recent years, suggesting that policy efforts to date have been inadequate to fulfill the demand for affordable housing that remains out of reach for Hoosiers.

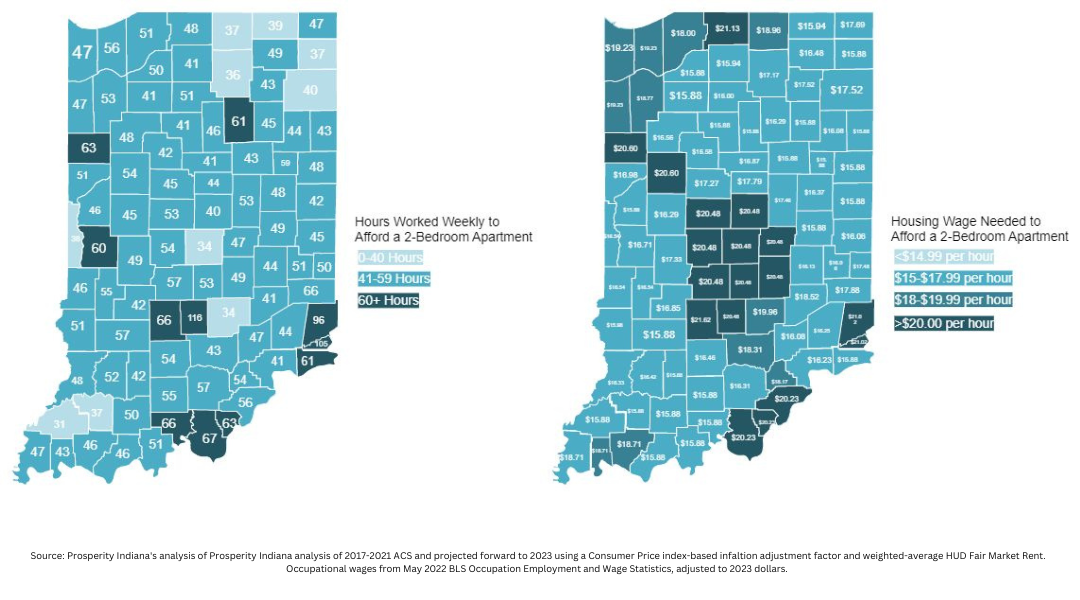

Throughout Indiana, a renter needs to earn on average $15.88 to $21.62 per hour, depending on their county of residence, to afford a modest two-bedroom rental home without spending more than 30% of their income on housing costs.

Click here to download the Indiana State Pages from Out of Reach 2023 which includes a state overview as well as county- and metro-level info for the FY23 Housing Wage, Housing Costs, Area Median Income, and Renter data.

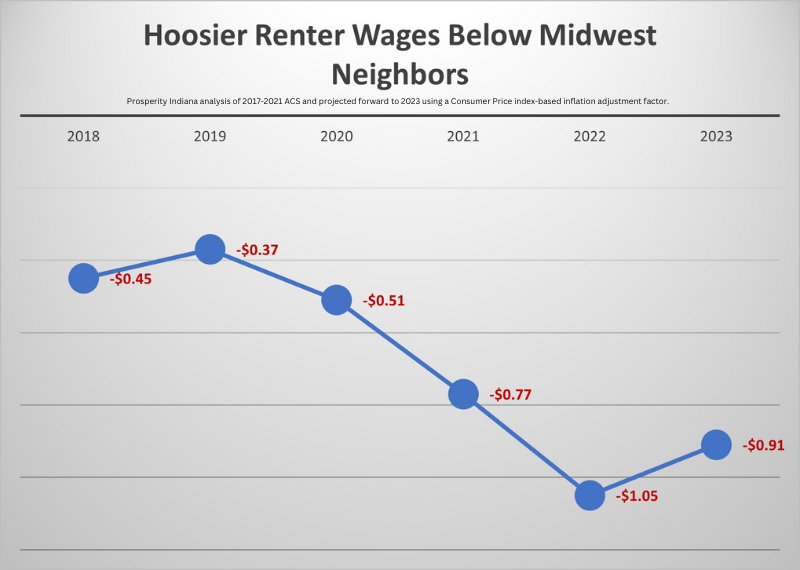

Despite a reputation of being a low-cost state, the Housing Wage in Indiana has worsened from 43rd-least affordable in the nation in 2021 to 38th in 2023. Among Midwest states, Hoosier renter wages remain persistently behind the average of the region. In 2023, the mean Hoosier renter wage of $17.86 is now $0.91 an hour lower than the $18.77 mean renter wage across all 12 Midwest states. This means the typical Hoosier renter working full time makes $1,893 less each year than their average Midwest counterpart. Policies that fill that wage discrepancy for Hoosiers would pay nearly 2 months of the state’s fair-market rent for a two-bedroom unit at $988/month.

The report also finds that in 2023, 10 of Indiana’s top 20 largest occupations pay a lower median wage than a full-time Hoosier worker needs for the state’s Housing Wage for a modest two-bedroom apartment at the state’s fair market rent. By contrast, just a year ago only 9 of the state’s top 20 occupations fell short of Indiana’s Housing Wage. These 10 occupations paying less than Indiana’s Housing Wage account for nearly 625,000 working Hoosiers, 57% of the total employed in the state’s 20 largest occupations, and more than a fifth of the state’s workforce. These occupations are frequently held by women, Hoosiers of color, and others making up Indiana’s extremely low-income renter households. Concentrating policy solutions on these key large occupations could unlock affordable housing and economic opportunities for hundreds of thousands of Hoosier households.

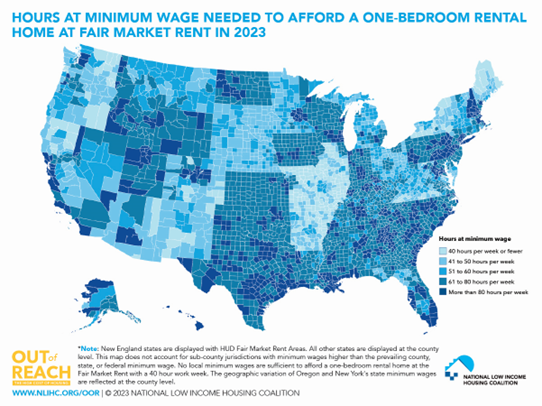

The increased cost of housing is also causing inflation in the number of hours Hoosiers working minimum wage must work to afford rent. The federal minimum wage has remained at $7.25 an hour, and $2.13 an hour for tipped jobs, without an increase since 2009, and Indiana has chosen to remain tied to that national wage floor. In no Indiana county or metro area can a minimum-wage renter working a 40-hour workweek afford even a modest studio rental unit at the average fair market rent. Working at the minimum wage of $7.25 in Indiana, a Hoosier wage earner must have 2.2 full-time jobs over work 86 hours per week to afford a modest one-bedroom apartment (up from 1.9 jobs over 76 hours in 2022); or work 2.6 full-time jobs over 105 hours per week to afford a two-bedroom apartment (up from 2.3 jobs and 94 hours in 2022. The hours necessary to work at the minimum wage to afford housing in most Indiana communities are higher than the hours necessary in many Midwest states and even some of the nation’s largest metro areas. But many Hoosiers making higher than minimum wage have seen the rising number of hours required per week to afford housing, taking time away from raising families and eroding quality of life without greater net compensation.

The Gulf Between Housing Costs and Wages – Voices of Hoosiers

Prosperity Indiana, its members, and partners in the Hoosier Housing Needs Coalition hear daily from Hoosiers caught in the gulf between increasing housing costs and stagnant wages that too often leads to eviction and homelessness. Here are some of the voices of those partners and the low-income tenants they serve:

Laurin Embry, Director of the Indiana Tenant Association and the Indianapolis Tenants Rights Union writes: “As a case manager it is becoming more common that I find myself working with families that have been torn apart by DCS due to the parents inability to afford housing. I am currently working with a couple whose children were removed due to the family experiencing homelessness. As a condition to regain custody of their children my clients are forced to pay several non-refundable housing application fees in an effort to secure housing; however many applications were denied with no explanation. Indiana's affordable housing crisis, lack of tenant protections and low wages make securing affordable housing a near impossible task. Those fortunate enough to afford housing now may later find themselves unable to maintain their housing if their rent is increased when it's time to renew their lease.” An unhoused Indianapolis resident told Embry "It feels like we are being set up to fail."

Joe from New Albany told his story to Will Stauffer, a Community Organizer with Hoosier Action: “I have two adult children, one is a son aged 30, who has a part-time job as a lifeguard at the YMCA and spends the rest of his time swimming for his health and as a masters swimmer nationally ranked. He and my daughter, aged 24, a student at IUS are living at home. Both would like to move out of the house, but the rental properties available are too expensive for them to afford. I do love my kids, and my wife and I might be labeled as “helicopter parents,” but that is not what keeps them at home—the high cost of rent keeps them at home. We need to do better for our citizens. I can’t imagine someone their age not having parents to live with as a backup plan. What are they doing for housing?"

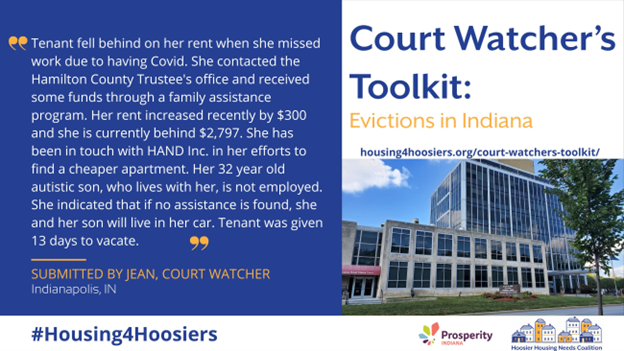

Jean from Indianapolis used Prosperity Indiana’s Court Watcher’s Toolkit and witnessed this tenant family’s experience in the courtroom:

“Housing is a human right,” said NLIHC President and CEO Diane Yentel. “Stable, affordable homes are a prerequisite for basic well-being, and no person should face the danger of losing their home. But, as the Out of Reach report shows, too many low-income renters now face worsening housing instability, as wages stagnate, housing costs rise, and pandemic-era safety net programs close down. Addressing the country’s long-term housing affordability crisis requires bridging the gap between rents and incomes through comprehensive federal legislation and adequate funding by Congress for our country’s vital affordable housing and homelessness programs.”

For additional information, and to download the report, visit: http://www.nlihc.org/oor

Special thanks to Laurin Embry of the Indiana Tenant Association and Indianapolis Tenants Rights Union, and Will Stauffer of Hoosier Action for coordinating quotes from Hoosier tenants.

###

ABOUT PROSPERITY INDIANA

Prosperity Indiana is a not-for-profit 501(c)3 organization formed in 1986 as the Indiana Association for Community Economic Development. PI is a network of approximately 200 organizations and individual members committed to advancing community economic development through our values of eliminating barriers, ensuring everyone has better opportunities to pursue the American Dream and prosperity for all. Visit the Prosperity Indiana website and follow @INCommDev on Twitter.

ABOUT THE NATIONAL LOW INCOME HOUSING COALITION

The National Low Income Housing Coalition is dedicated to achieving racially and socially equitable public policy that ensures people with the lowest incomes have quality homes that are accessible and affordable in the communities of their choice. NLIHC educates, organizes, and advocates to ensure decent, affordable housing for everyone. For more information about NLIHC, please visit www.nlihc.org.